The Commodities Feed: Muted response to phase one deal

Your daily roundup of commodity news and ING views

Energy

The phase-one trade deal was finally signed yesterday, and the reaction from energy markets was fairly muted. In fact, oil settled lower on the day. Looking at the detail, from the 2017 baseline, China is set to buy an additional US$52.4b worth of US energy products over the next 2 years, with US$18.5b more to be purchased in 2020, and US$33.9b more in 2021. The energy products included are LNG, crude oil, refined products and coal. These flows have largely dried up since the start of the trade war, and so a resumption of flows would be welcome news to US producers. Looking at US crude oil and refined product exports to China, these peaked at 773Mbbls/d in October 2017, while in October 2019 they fell to just 36Mbbls/d. Then on the LNG side, EIA data shows that China has not imported any US LNG since April 2019. A resumption of US LNG flows to China would not only be welcomed by US producers, but also gas longs in Europe, which have seen increased flows of US LNG cargoes into the region, helping to take EU natural gas inventories to at least 5-year highs.

Moving away from trade, and yesterday also saw the EIA release its weekly oil report, which showed that US crude oil inventories fell by 2.55MMbbls over the last week, compared to the 1.1MMbbls build the API reported the previous day. While this may appear fairly constructive, the report was bearish, with total crude oil and product inventories increasing by 14.46MMbbls. The key drivers behind this build were distillate fuel oil and gasoline, which saw stock builds of 8.17MMbbls and 6.68MMbbls respectively. The refined product build was largely driven by a fall in exports, with total product flows falling by 354Mbbls/d over the week to 4.82MMbbls/d - levels last seen in early November. The strong builds reported will certainly do little to support refinery margins in the short term, which have been under pressure for some time now.

Turning to OPEC, and the group released its monthly oil market report yesterday, which showed that production for the group over December came in at 29.4MMbbls/d, down 161Mbbls/d MoM. The reduction was largely driven by Saudi Arabia, where output fell by 111Mbbls/d to average 9.76MMbbls/d for the month. The Kingdom continues to show its commitment to the output cut deal, with its over-compliance. Meanwhile, the group is also forecasting that non-OPEC supply will grow by 2.35MMbbls/d in 2020 (slightly higher than their forecast from last month), which would leave the call on OPEC production at 29.47MMbbls/d over 2020, which is roughly in line with December output. However, looking at the numbers on a quarterly basis tells a slightly different story, with the call on OPEC supply at 29.18MMbbls/d and 28.56MMbbls/d in Q1 and Q2 respectively.

Finally, following previous media reports that OPEC+ was looking to potentially delay its meeting until June, more recent comments from Russia and the UAE suggest that as of now the meeting will still take place in March.

Metals

Iron ore futures softened yesterday, as the market took note of subdued demand forecasts from China’s Iron and Steel Association (CISA). The CISA has estimated that the country’s steel demand growth could slow from 6% in 2019 to 2% in 2020, which would weigh on iron ore demand as well. On the supply side, the threat of disruption in Australia’s Pilbara region from cyclone Claudia seems to have eased. However, with it being cyclone season in Australia, the risk of supply disruptions remains over 1Q20. Meanwhile the iron ore quality premiums for 66% iron ore fines over the 62% strengthened further to US$11/t compared to an average of US$8/t in December 2019, with an improvement in mill margins supportive for demand of higher quality iron ore.

Agriculture

Grain markets didn’t show much excitement to the signing of the phase-one trade deal, with both CBOT soybeans and corn settling largely flat to lower on the day. Under the deal, China will buy US$32b more of US agricultural products over the next 2 years, with an additional US$12.5b this year, and US$19.5b more in 2021. According to USDA numbers, the US exported US$19.6b worth of agricultural goods to China in 2017, the baseline year for this deal. This does suggest it will be a very difficult task, given the need for China to almost double imports by the end of 2021. However, what may help China move closer to this target is to significantly increase ethanol imports. There are still reports that China will roll out a nationwide 10% ethanol mandate this year, which would see a drastic increase in domestic ethanol demand. However given domestic capacity constraints, if the government was to implement the mandate this year, the country would need to turn to the import market to meet a large part of this additional demand. Given that the US is the world’s largest ethanol producer, they do stand to benefit from this, and under the phase-one deal, ethanol falls under agriculture, rather than energy.

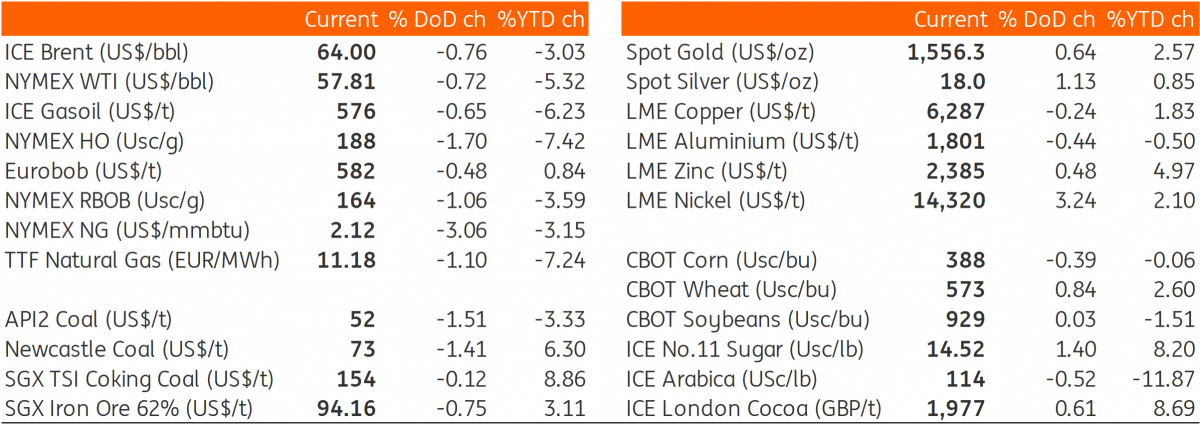

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap