The Commodities Feed: Middle East tension

Your daily roundup of commodity news and ING views

Record Chinese steel output (m tonnes)

Energy

Growing tensions in the Middle East: ICE Brent rallied back well above US$71/bbl yesterday, following reports of an attack on the key East-West Pipeline, which has forced it to temporarily shut. Yemen’s Houthi rebels claimed responsibility for the attack. The pipeline has a capacity of 5MMbbls/d, but reportedly less than 50% of the pipeline’s capacity is used. The pipeline offers an alternative route for crude oil exports through the port of Yanbu on the West Coast, rather than going through the Strait of Hormuz in the East. The pipeline also feeds refineries in Yanbu. The Saudi Energy Minister has said that exports of both crude oil and refined products continue uninterrupted despite the attack.

US crude oil inventories: The API reported yesterday that US crude oil inventories increased by 8.63MMbbls over the last week, which was very different from the 1.2MMbbls drawdown that the market was expecting, according to a Bloomberg survey. Meanwhile, the API also reported that gasoline and distillate fuel oil saw stock builds of 567Mbbls and 2.17MMbbls, respectively. The more widely followed EIA report will be released later today and numbers similar to the API would likely be seen as bearish in the immediate term.

Metals

Chinese metal output: Chinese steel production increased 13% YoY to a record high of 85.03mt in April, with steel mills increasing utilisation rates on the back of stronger margins. Cumulative output over the first four months of the year is up 10% YoY to total 315mt. Margins moving forward though could come under pressure, with the more recent strength in Chinese steel prices reflecting stock building following the Chinese New Year.

Aluminium output in the country also increased 3.9% YoY to 2.92mt over the month (97.3kt per day), while cumulative production over the first four months of 2019 totalled 11.5mt, up 4.1% YoY.

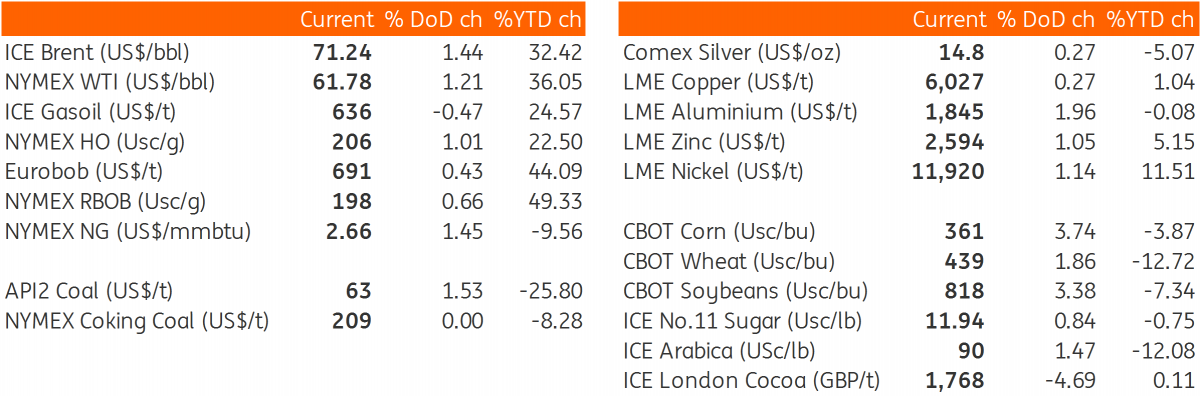

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap