The Commodities Feed: Metals under pressure

Your daily roundup of commodity news and ING views

Energy

Oil prices came under further pressure yesterday. ICE Brent settled 1.85% lower on the day, leaving it at levels last seen in early December, with worries over the Wuhan virus and what it could mean for oil demand. Like much of last year, this latest development illustrates well that the market continues to focus more on macro events, rather than specific market fundamentals - the downward price action a result of the virus more than offsetting the gains seen following Libyan supply disruptions. One would also think the supply losses from Libya would far outweigh the potential demand losses from the Wuhan virus.

Yesterday the EIA released its weekly oil numbers, where it reported that US crude oil inventories fell by 405Mbbls over the last week. This was somewhat different to the 1.57MMbbls build that the API reported the previous day. Meanwhile crude oil stocks in Cushing fell by almost 1MMbbls whilst product builds were significantly less than the market was expecting. Gasoline stocks increased by 1.75MMbbls over the week, compared to a 4.51MMbbls build reported by the API. For distillate fuel oil the EIA reported a surprise stock drawdown of 1.19MMbbls. Overall the report was constructive but clearly overshadowed by developments in Asia.

Metals

Fears continue to grow over the spreading of the coronavirus, and this is being felt in global markets including industrial metals. The pressure on the metals complex should be somewhat expected, given that China is the world’s largest metal consumer and any slowdown in industrial activity could start to weigh on metals demand. With the Lunar New Year holidays, demand is expected to be seasonally weak, and this is reflected in domestic stocks edging higher more recently. Over the next week, while there will likely be plenty of noise out of China related to the virus from a market point of view it will be quiet, with SHFE now shut until the end of January.

Looking at SHFE stocks, over the week zinc inventories saw significant gains and rose by 22% to total 49.2kt. However stock gains over the course of the year show much more modest increases, particularly when you consider the strong production growth seen in China over the last year. We touched on zinc's tangible stock issue yesterday. Looking at the China market, where almost half of the world's smelting capacity sits, the expected surplus did not feed through to the exchange. There might be some statistical issues in terms of zinc production from smelters as to whether they are in the form of ingots (exchange deliverable), or zinc alloys (not tradeable on SHFE). We also understand that there has been more shipments directly between smelters and users and these ingots do not appear in the market at all. There may be some other factors also at play, but it all comes down to the question of when will there be more tangible evidence of stock building? This will be key for markets.

A similar situation has occurred in the Chinese aluminium market, where this is a growing amount of molten aluminium supplied directly to alloy makers or increased alloys in the overall product portfolio. There are also reports of some issues with packaging standards, which might be having an impact on some of this metal being accepted. Stocks in SHFE warehouses have been mostly in a downward trend, and intra-year have fallen by 67% to total 231kt. A fall in domestic production would have also helped, with Shanghai Metals Market data showing Chinese aluminium output over 2019 falling by 1.4% YoY - a factor which also saw SHFE outperform the LME market. For 2020, this trend is expected to change, with the market expecting a surplus to build up as a result of a supply recovery from ramp-ups and restarts.

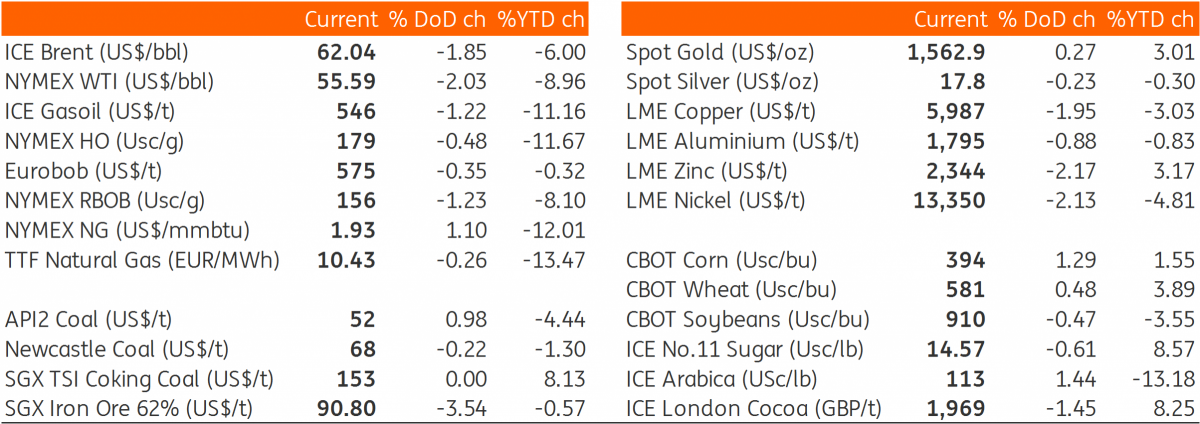

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap