The Commodities Feed: Long awaited US oil drawdowns

Your daily roundup of commodity news and ING views

Energy

Looking at where oil markets settled yesterday, one wouldn’t have thought that the EIA reported the first drawdown in US crude oil inventories since mid-January. US crude oil inventories declined by a modest 745Mbbls over the week, while stocks at Cushing, the WTI delivery hub, fell by a little over 3MMbbls, which is the biggest weekly drawdown at Cushing so far this year. To add to the more supportive numbers, gasoline inventories also fell by 3.51MMbbls over the week, whilst gasoline demand (product supplied) increased by 734Mbbls/d to average 7.4MMbbls/d. Gasoline demand has now increased by more than 2.3MMbbls/d since the lows seen in early April. However, there is still some way to go before returning to normal, with pre-Covid-19 gasoline demand in the US at 9MMbbls/d +.

Sticking with demand, and yesterday the Saudi and Russian energy ministers released a joint statement, where they said they were happy with some indicators which show that global oil demand is starting to recover, and concerns over storage limitations are easing, as countries exit strict lockdowns. The ministers also used the statement as an opportunity to emphasise their commitment to the OPEC+ deal, along with the belief that other OPEC+ members will comply with the deal.

OPEC released its monthly market report yesterday, and this made for bearish reading, with the group making some large revisions to its demand estimates for this year. The group estimate that oil demand over 2Q20 will fall by 17.26MMbbls/d YoY. Full-year 2020 demand is now expected to be down 9.07MMbbls/d YoY, compared to a previous forecast of a 6.85MMbbls/d YoY decline. This revision lower in demand means that the call on OPEC output will also be lower, despite revisions lower in non-OPEC supply. Over 2Q20, demand for OPEC oil is just 16.77MMbbls/d, well below OPEC output levels, even when full compliance of OPEC+ cuts are taken into consideration.

Metals

In precious metals, gold prices traded higher, following comments from the US Fed. While palladium came under pressure, down as much as 4% at one stage, and trading below US$1,800/oz. Palladium prices have fallen around 35% from the recent highs seen in February, given the pressure that the global auto industry is under at the moment - a key source of demand for palladium. One major palladium producer, Norilsk Nickel expects a balanced market for palladium in 2020 due to a combination of higher output from South African producers and weaker demand from the auto industry.

In base metals, prices remained under pressure, along with other risk assets, with negative comments from the US Fed stating that the US could face an ‘extended period’ of weak growth, while worries over a possible second wave of Covid-19 are not helping sentiment.

Meanwhile, LME copper inventories have continued to decline, and again this is mainly occurring at Asian warehouses. Up until now though, these stock drawdowns are not having too much of an impact on LME copper spreads, with the cash/3m spreads still in deep contango. In China, the spread between bare bright wire and cathode has closed. The scrap import market is expected to improve as supply chains start to recover. We expect higher scrap shipments from Malaysia and Europe to China from May, but can’t rule out tightness to persist for the full-year view.

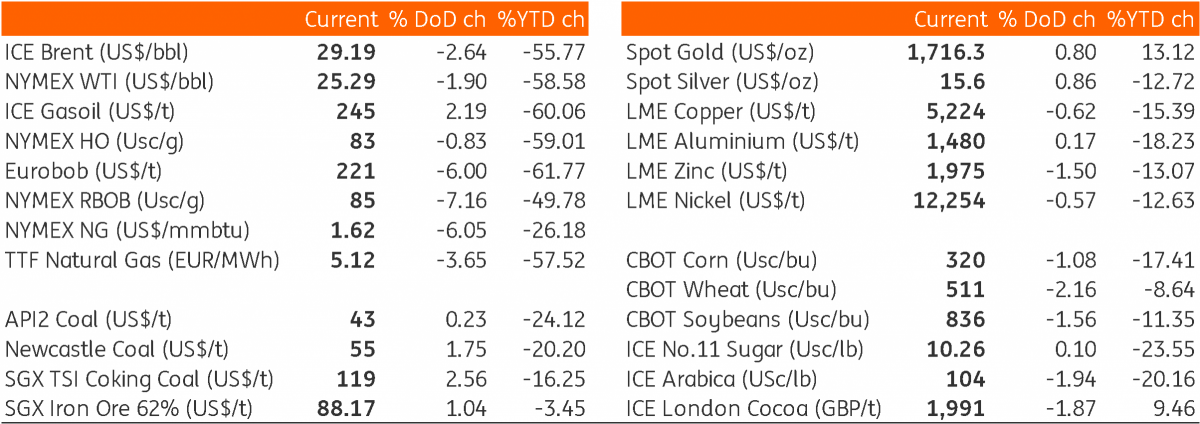

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap