The Commodities Feed: Limited spec buying in oil

Your daily roundup of commodities news and ING views

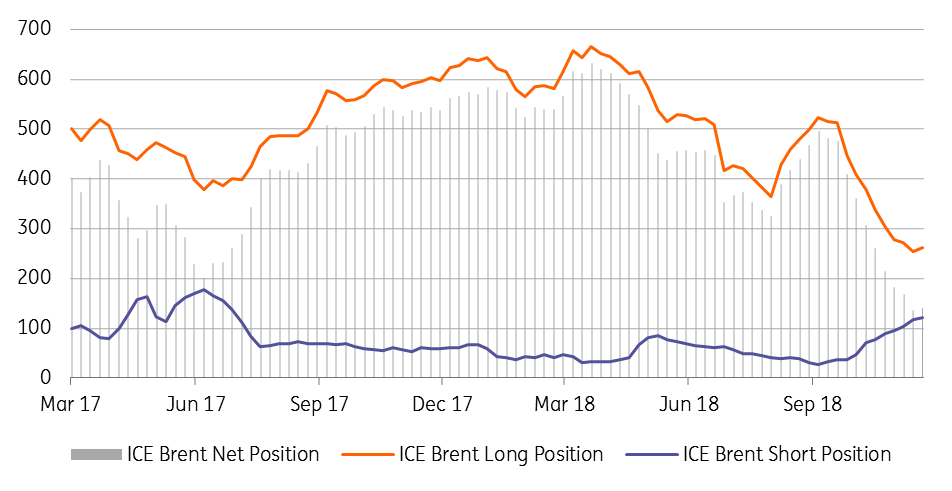

Speculators underwhelmed by OPEC+ cuts (000 lots)

Energy

Oil speculative positioning: Latest exchange data shows that over the last reporting week, speculators increased their net long in ICE Brent by 3,131 lots to leave them with a net long of 139,597 lots. This limited amount of spec buying clearly indicates that speculators were left underwhelmed following the OPEC+ meeting on the 7th of December. Meanwhile, CFTC data shows the speculators reduced their net long in NYMEX WTI over the last reporting week by 8,638 lots, leaving them with a net long of 119,675 lots.

US oil drilling: Data released by Baker Hughes on Friday showed that the number of active oil rigs in the US fell by 4 to 873 last week, after declining by ten the week before. The sell-off we have seen in the market recently is unlikely to help see a pick-up in rig activity anytime soon. Meanwhile today, the EIA is scheduled to release its monthly Drilling Productivity Report.

Metals

Precious metal speculative positioning: Money managers switched back to holding a net long in COMEX gold for the first time since July, with them buying 11,791 lots over the last reporting week, leaving them with a net long of 10,252 lots. The increase was driven by short covering, with shorts buying back 19,617 lots over the reporting week. Similarly, speculators reduced their net short in silver, with them buying 13,209 lots to leave them with a net short of 8,968 lots now.

Copper smelter restart: Vedanta could restart its 400ktpa copper smelter in India after being forced to shut by the state government in 2Q18 following protests related to pollution. India’s Green Tribunal has allowed the company to reopen the smelter, with the company being asked to implement further pollution control and monitoring mechanisms. Although there are media reports that the Tamil Nadu government will challenge this latest ruling.

Agriculture

Specs buy corn: Latest CFTC data shows that speculators increased their net long in CBOT corn by 44,872 lots over the last reporting week, leaving them with a net long of 98,617 lots. This is the largest position that they have held in corn since June. Sentiment in Agri markets has improved with a slight thawing in trade tensions between China and the US.

Also fundamentally, the outlook for the corn market is relatively more constructive than the wheat and soybeans. The USDA forecasts that 2018/19 global ending stocks for corn will total just 308.8mt tonnes, down from 340.2mt last season, and the lowest stocks since the 2014/15 season.

Daily price update