The Commodities Feed: Iron ore sell-off

Your daily roundup of commodity news and ING views

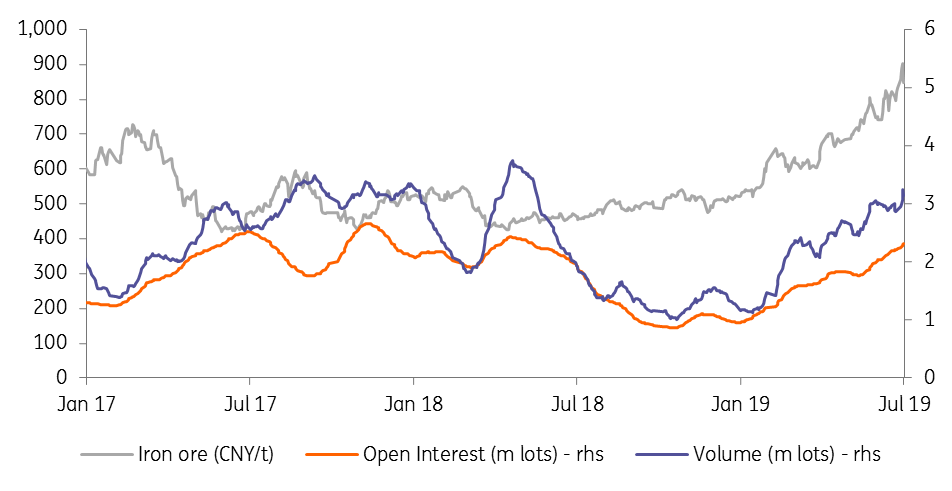

Dalian iron ore futures market activity

Energy

Saudis cut OSP: In another sign of a weakening market, Saudi Aramco has cut its official selling price (OSP) for Arab Light into Asia by US$0.25/bbl month-on-month to US$2.45/bbl over the Oman/Dubai benchmark. This was the first decline in this OSP since the start of the year.

Product inventories: Latest data from Insights Global shows that refined product inventories in the ARA region increased by 60kt over the week to total 6.31mt. This increase was driven by a 173kt build in gasoil inventories. However gasoline stocks did decline by 116kt over the week to total 1.12mt. The gasoline draw has been supportive for gasoline cracks, and this decline has been largely driven by a surge in gasoline flows from Europe to the Americas on the back of the PES refinery shutdown. Low gasoline stockpiles on the US east coast are likely to continue supporting this flow moving forward, and as a result, also offer further support to European gasoline cracks.

Metals

China iron ore: The Dalian iron ore active contract has retreated nearly 6% over the past two days as reports emerged that Chinese authorities might investigate the sharp rise in iron ore prices and target price manipulation after China Iron and Steel Association raised concerns on the matter. The association has been apprehensive about the eroding profitability of steel mills and its impact on the industry if iron ore prices continue the uptrend. Both volumes and open interest in Dalian iron ore futures have increased significantly since the Vale incident in Brazil, signifying a rise in speculative activity. Meanwhile, market fundamentals have turned softer as exports from Brazil recover and Vale received the green light to restart its 30mtpa Brucutu mine.

Zinc smelting margins: The LME zinc market appears to have been under long liquidations over the last couple of days. Despite LME inventories trending lower, outright zinc prices have decreased to a six-month low. The cash-3 month spread has also retreated from its multi-year high of $160 at the end of May. From a fundamental perspective, refined zinc’s total supply is rising. In particular, the operating rate from Chinese large scale smelters has increased during June on the back of higher margins, which is helping to speed up output growth. For China, we are forecasting the market will enter into surplus from July, and remain there for the remainder of the year.

Agriculture

Argentina harvest: In its weekly report, the Buenos Aires Grains Exchange reported that the soybean harvest in the country came to an end, with around 56mt of soybeans produced in 2018/19, up 60% year-on-year. For corn, harvesting increased to 49.3% last week compared to 46% in the previous week, although it’s down compared to a five-year average of 60% at this stage in the year. The current crop remains in good condition with only 3.9% of the crop being in the poor and very poor category. Corn production estimates for the season were left unchanged at 48mt, up 51% YoY.

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap