The Commodities Feed: Gasoil-fuel oil spread increases further

Your daily roundup of commodity news and ING views

Gasoil-HSFO price spread (US$t)

Energy

US oil inventory: The weekly EIA report yesterday was fairly soft for oil prices with US crude oil inventories reportedly up by 7.9MMbbls over the last week, significantly higher than the 4.3MMbbls build that the API reported and the c.2MMbbls inventory gain that the market was expecting, according to a Bloomberg survey. The biggest factor for the inventory build was the sharp downtick in US crude oil exports, which dropped by 956Mbbls/d week-over-week to 2.37MMbbls/d. On products, refinery utilisation dropped by 1.7% to 86% due to prolonged maintenance work at some of the refineries. Lower refinery output has pushed the products inventory down. The EIA reported that gasoline inventories dropped by 2.83MMbbls last week while distillate stockpiles were down by 622Mbbls.

Gasoil-fuel oil spread: As the deadline for IMO’s new bunkering fuel approaches, demand for shipping fuel continues to shift from HSFO to the low sulphur gasoil, as ship owners prepare to comply with the new regulations. The premium of gasoil over the HSFO increased to a five-year high of US$370/t this week compared to the US$200-250/t in 1H19 and the year-to-date average of US$246/t. An alternative to the fuel switch, either a scrubber installation or LNG-powered ships, remains in short-supply for now. Lower demand has been weighing on the HSFO prices with cracking margins falling to a record low of negative US$30/bbl in the European market, significantly down compared to negative US$6/bbl at the start of the year.

Metals

Lead outlook: The phase one trade deal between China and the US has yet to materialise so far, and on Wednesday the industrial metals complex failed to extend the gains we saw on Tuesday. Lead was at the forefront of the decline on Wednesday. We think that LME lead is now facing a dilemma as to whether it follows the recent slump on the ShFE where most of the headwinds are coming from. Low LME inventory has helped to keep prices stronger than ShFE for most of the year. Supply from the western market has remained largely muted with Port Pirie yet to get back to normal. Meanwhile, demand is expected to increase in winter. However, recently there has been increased pressure from China. First, secondary supply is rising, driven by increased production margins. This is reflected in the widening discount of secondary lead to the primary. However, there is always a question regarding the sustainability of secondary supply from this market. Second, there's been a strong uptick in ShFE stocks. In the very short term, a pullback in LME lead looks inevitable but we don't see significant downside before a tangible rise in stocks. Another possible outcome might be that the divergence between the two may remain in place for a while and even widen.

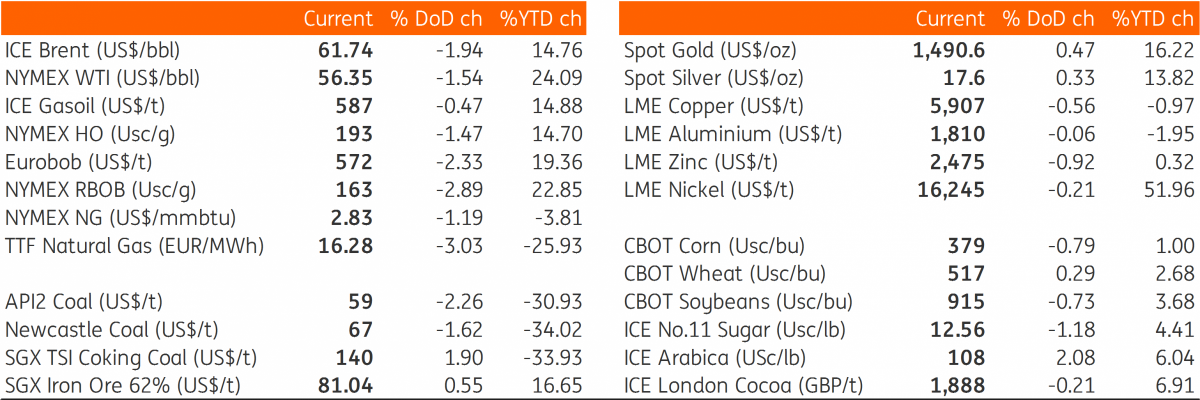

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap