The Commodities Feed: Further US inventory draws

Your daily roundup of commodity news and ING views

Energy

The WTI June contract managed to avoid a repeat of the negative prices that we saw for the May-20 contract expiry, with the Jun-20 contract expiring at US$32.50/bbl yesterday, whilst the Jun/Jul time spread also managed to settle in backwardation. Sentiment has clearly shifted significantly over the last month in the market.

However the strength that we have seen in the market over the last few days seems to have been exhausted, with ICE Brent yesterday settling lower for the first time since last Wednesday. It’s no surprise that the market needs to take a breather, with Brent rallying by around 80% over the last month or so. Fundamentals in the market are improving, thanks to supply cuts and recovering demand. However poor refinery margins suggest that this strength is unlikely to be sustainable in the near term. We would need to see strength in refinery margins in order to persuade refiners to increase utilisation rates, but at current levels there seems little incentive for them to do so, with many regions still seeing negative margins. Then, as we have mentioned in previous reports, further strength in the oil market would send the wrong signal to producers, with them likely more reluctant to cut output in a rallying market.

The API yesterday reported that US crude oil inventories fell by 4.84MMbbls over the last week, if the EIA reports a similar number later today, it would be the largest stock drawdown since December. Similarly, the API also reported a 5.04MMbbls drawdown in inventories at Cushing. The product side was less constructive, with a gasoline draw of just 651Mbbls, whilst distillates saw a build of 5.08MMbbls.

Finally, regulators in North Dakota will today be meeting to discuss production quotas for producers in the state. North Dakota is a fairly small producer, pumping around 1.4MMbbls/d, significantly less than the 5MMbbls/d plus that Texas produces.

Metals

Market sentiment has remained largely buoyant for the metals complex, amid optimism of reopening of multiple economies. Investors may be cautious ahead of the China NPC sessions, as many in the market await more on the growth target for this year. Meanwhile weak vehicle sales data from Europe and falling US home construction data have been largely ignored.

Meanwhile China has issued a seventh batch of copper scrap import quotas for 10.4kt, bringing total approved quotas so far this year to 540kt. The total volume approved so far is much higher than we saw over the same period last year. However, in the short term, the size of the of quota may be less relevant, with real supply impacted by Covid-19 related supply-chain disruptions. With the spread between cathode and scrap narrowing, this has pointed to a reduced amount of cathode being used to fill the void in scrap supply. On the other hand, with an open import arbitrage window, and the Yangshan premium soaring to an almost two-year high, it does suggest the strong need for cathode imports

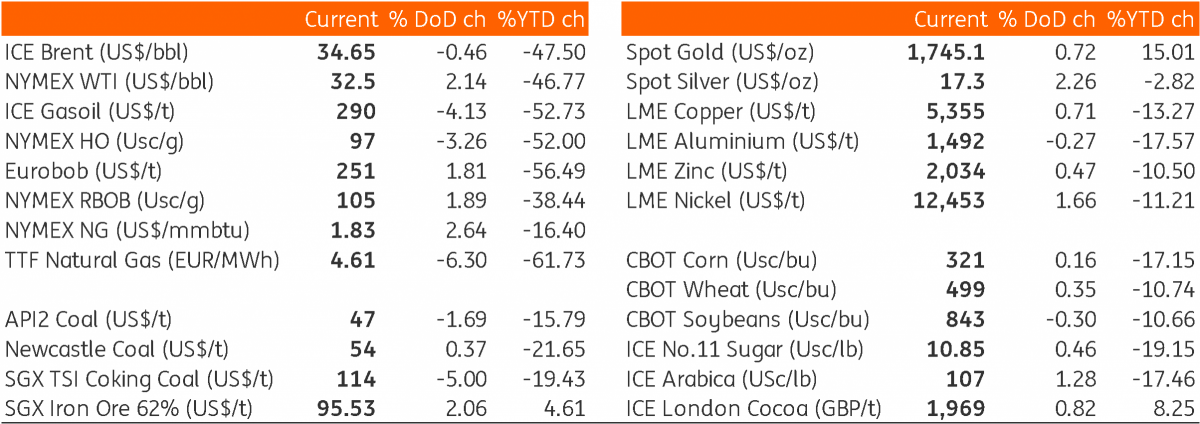

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap