The Commodities Feed: Further tightening in oil supply

Your daily roundup of commodity news and ING views

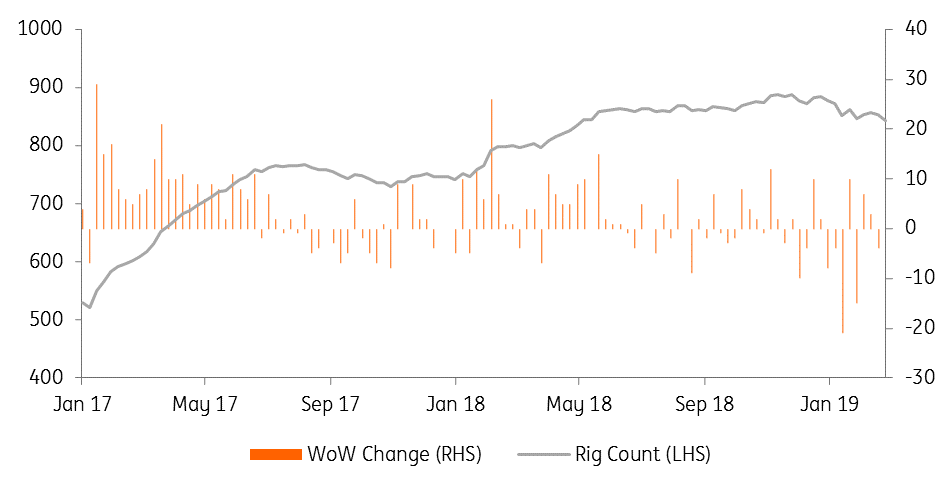

US oil rig count falls

Energy

US rig count falls & OPEC: The latest data from Baker Hughes shows that the US oil rig count declined by 10 over the last week to total 843 active rigs. This is the lowest number seen since May, and much of this slowdown is likely a result of the price weakness that we saw over much of 4Q. Meanwhile, OPEC production numbers are starting to come through, which show growing compliance with the OPEC+ deal. The UAE reported that its production averaged 3.05MMbbls/d over February compared to its agreed level of 3.07MMbbls/d. In fact, Bloomberg estimates that OPEC production averaged 30.5MMbbls/d over February, down 560Mbbls/d month-on-month.

As for non-OPEC members of the deal, while Russia continues to move closer towards its agreed production level, it still has some way to go. Under the deal, Russia agreed to reduce output to 11.19MMMbbls/d, however output over the month of February averaged 11.34MMbbls/d, according to government data, down just 40Mbbls/d MoM.

We believe that growing compliance with the OPEC+ deal and slowing rig count in the US should remain fairly supportive for the oil market.

Speculative positioning: Over the last reporting week, speculators increased their net long in ICE Brent by 15,887 lots to leave them with a net long of 291,336 lots as of last Tuesday- the largest position held since October. While much of the move higher in the market has come about due to short covering, in more recent weeks we have seen fresh longs starting to return to the market, suggesting that sentiment is turning more positive. Over February the gross long position increased by almost 69k lots, whilst the gross short position saw an increase of a little over 9k lots.

Metals

Trade talks progress: It appears that trade talks are continuing to move in the right direction, with the Wall Street Journal reporting that China and the US are in the final stages of reaching a trade deal, which would see both sides remove almost all tariffs put in place last year. Whilst constructive, this latest news has had little impact on the base metals complex, with both aluminium and copper trading marginally lower so far this morning.

China zinc treatment charges: Chinese zinc treatment charges have continued to strengthen, now at US$245/t. This compares to US$165/t at the end of 2018, and just US$15/t at the same stage last year. Treatment charges have strengthened along with the improvement in global concentrate supply, and higher treatment charges is a trend we are seeing around the world.

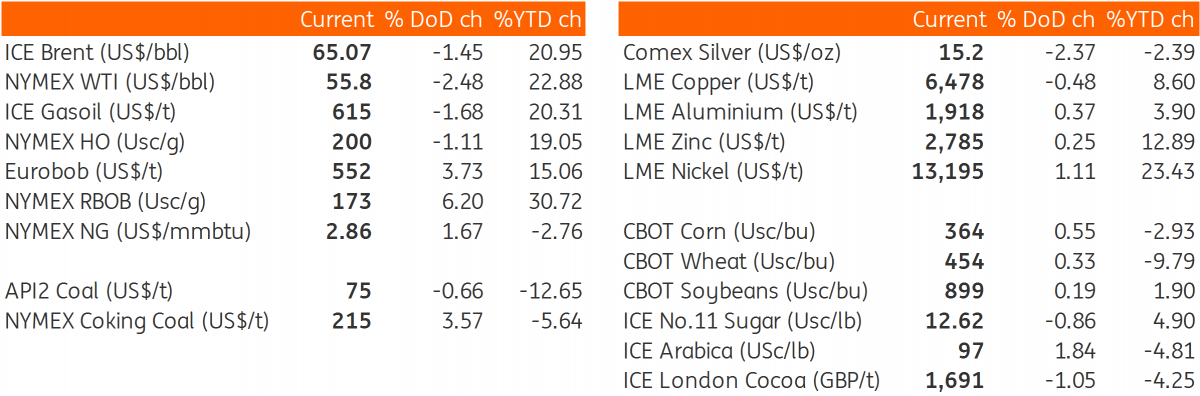

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap