The Commodities Feed: Flat price weakness & spread strength

Your daily roundup of commodity news and ING views

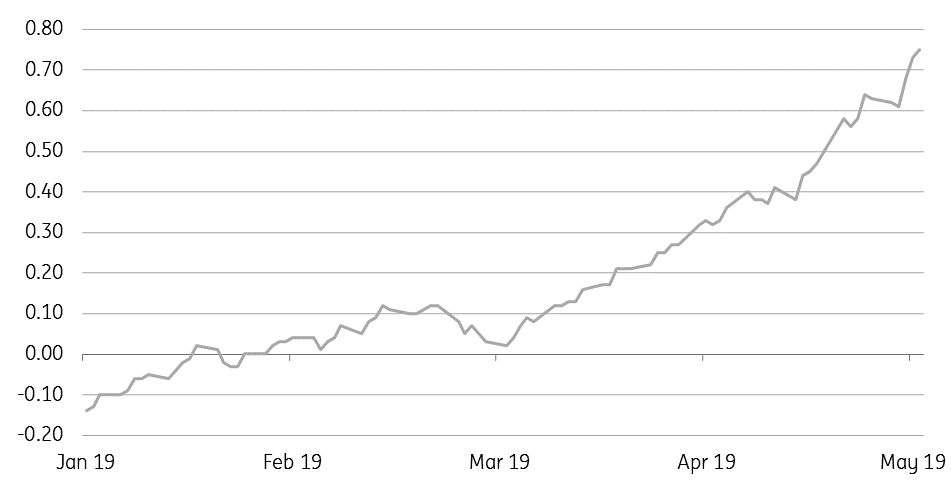

ICE Brent Jul/Aug spread continues to strengthen (US$/bbl)

Energy

Flat price weakness & spread strength: The oil market came under further pressure yesterday with ICE Brent trading below US$70/bbl at one stage, and settling 2.8% lower on the day. The flat price seemed to show little concern for the ending of Iranian waivers on Thursday. However the Brent time spreads tell a different story. The Jul/Aug spread continues to move into deeper backwardation, with the spread trading as high as US$0.78/bbl this morning, up from US$0.61/bbl on Tuesday. This spread strength does suggest that the spot physical market continues to tighten.

Meanwhile, Russian production data shows that oil output over the month of April averaged 11.23MMbbls/d, down from 11.3MMbbls/d in March. However Russia continues to fall short of their agreed production level of 11.19MMbbls/d.

Europe product inventories: Latest data from PJK International shows that independent refined product inventories in the ARA region increased by 139kt over the last week to total 5.67mt. The increase was driven by gasoline, where inventories increased by 108kt over the week. This has seen gasoline stocks bounce back up above the five-year average. This increase in inventories comes despite the strong flow of gasoline we have seen to the Americas over April, with US inventories continuing to trend lower.

As we see US refineries returning from maintenance, this could weigh on Europe-America flows, leading to gasoline inventories in the ARA region trending higher in the near term.

Metals

Brazil iron ore exports: Data from Brazil’s Ministry of Trade and Commerce shows that iron ore exports from the country fell 29% year-on-year (down 17% month-on-month) to a seven-year low of 18.3mt in April, following the Vale dam disaster. Lower shipments from Brazil have weighed on Chinese port inventory of iron ore, which has declined by around 13mt over the past three weeks. Meanwhile, China’s steel production continues to grow strongly on improving margins.

LME aluminium inventories: LME aluminium inventories increased by another 92.4kt yesterday, taking total inflows to around 207kt over the past four days. The majority of the inflows were into Malaysia’s Port Klang warehouse. These inflows have weighed on the cash/3M spread, with the contango widening to US$19.50/t yesterday.

Agriculture

Argentine corn: Expectations for the Argentinian corn crop continue to improve, with the Buenos Aires Grain Exchange increasing their corn output estimate for the 2018/19 crop to 48mt, 2mt higher than their previous estimate, and significantly higher than the 31.7mt produced last season. Argentina is seeing a change in fortunes. Poor weather last season hit both the corn and soybean crop but the weather this season has been ideal.

Improving corn prospects in South America come at a time when US farmers are expected to increase corn area by 4% in 2019 (at the loss of soybean area), as a result of the ongoing trade war between China and the US.

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap