The Commodities Feed: EIA builds

Your daily roundup of commodity news and ING views

Energy

US stocks builds have put renewed pressure on the oil market, with ICE Brent settling lower on the day, but still managing to close above US$64/bbl. The EIA reported yesterday that US commercial crude oil inventories increased by 1.57MMbbls over the last week, and while this was less than the 3.46MMbbls build that the API reported the previous day, it was still fairly different from the 878Mbbls drawdown the market was expecting, according to a Bloomberg survey. This is now the fifth consecutive week that the EIA has reported a build, and has taken total US crude oil inventories to almost 452MMbbls- widening the gap to the 5 year average of around 440MMbbls for this stage in the year. There were two key factors which led to the large build, firstly we did see a 1.37MMbbls SPR release, and secondly refinery utilisation rates should be increasing around this time of year, following the turnaround season, but instead, we saw a small drop in refinery run rates for the week.

What was more bearish in the EIA release, and which is reflected in the gasoline crack, was the 5.13MMbbls gasoline build, which has pushed US gasoline inventories to at least a 5 year high for this time of the year. The key behind this build appears to be stronger gasoline imports into both the East and West Coast. Moving forward, we should expect to see gasoline inventories continuing to edge higher, as refineries return from turnaround season, and demand edges lower.

Turning to Russia, Reuters reports that Russia may call on OPEC+ members for a change in the way its production cuts are measured. The Russians have been including condensate output in their crude oil production numbers, and given the growth that the country is seeing in gas output, this has meant that condensate production has increased as well. This would help to explain why Russia has failed to fully comply with the production cut deal for much of this year. If these media reports are correct, this will likely be a matter that will be discussed at the OPEC+ meeting next week.

Finally, moving away from oil and turning to LNG, latest numbers out of Japan this morning show that LNG imports over October totalled 6.3mt, a decline of 2.2% MoM. This follows weak import numbers from China for October, where flows totalled 4.04mt- a reduction of 20% MoM. These declines are fairly surprising, as one would expect to see a pick up as we move closer to winter. Faltering demand now in the LNG market would not be good news for the bulls, given that we continue to see a ramping up in LNG supply.

Metals

The base metals complex continues to be fairly well supported, with LME copper managing to close higher on the day, and edging ever closer to the US$6,000/t mark. Meanwhile with the exception of nickel, the rest of the complex remained little changed at settlement. Metals appear to be in a holding pattern, with a lack of any fresh developments in terms of trade negotiations.

Meanwhile China’s headline industrial profit data was not constructive, falling 9.9% YoY in October. However, this headline number does mask some rather significant differences, with infrastructure-related industries performing well, while trade-related manufacturers have suffered unsurprisingly. This poor data may be overshadowed by the Ministry of Finance's announcement that China will bring forward its $142b of 2020 local government special bonds quota to this year. These bond issuances are designed to underpin infrastructure investment, and in theory, should offer some support to domestic metals demand over 1H20.

Moving on to aluminium, and the week-long rail strike in Canada ended yesterday after unions and railways reached an agreement. Resolution of the rail strike removes short-term uncertainty for the US metal market, with Canada a major supplier of aluminium and steel to the US. In fact, Rio Tinto declared ‘force majeure’ on its Canadian aluminium supplies to the US due to the rail-strike - although this might be short-lived, with the strike now over.

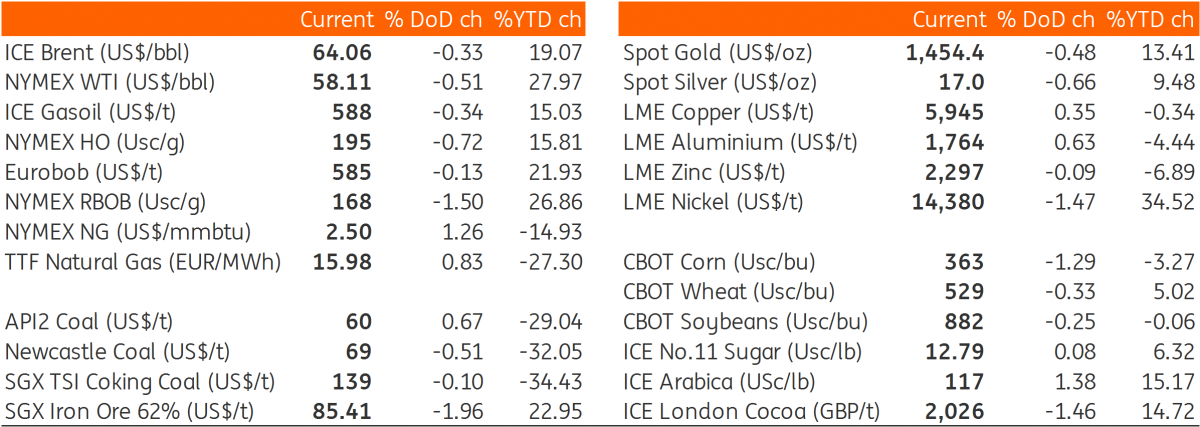

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap