The Commodities Feed: Demand revisions

Your daily roundup of commodity news and ING views

Energy

Oil prices managed to settle higher yesterday, with ICE Brent closing almost 1.4% higher over the day. In early morning trading today, the market has continued to strengthen. This is despite little clarity on what OPEC+ will do, and the longer we wait, the more likely the meeting will stay put for early March. The API also reported fairly bearish inventory numbers, showing that US crude oil inventories increased by 6MMbbls over the last week, much more than the 3.2MMbbls increase the market was expecting, according to a Bloomberg survey. This only reinforced the trend seen in the WTI/Brent spread yesterday, with the discount widening as the day progressed, and ending the day at more than a US$4/bbl discount. This is a reversal to what we have seen in recent weeks, with the spread previously narrowing significantly on the back of demand worries from the coronavirus. Meanwhile Qingdao port has said that offtake from storage at the port has slowed, highlighting the reduced run rates we are seeing from refiners in the country as a result of the coronavirus.

Yesterday, the EIA released its monthly Short Term Energy Outlook, where it revised lower global liquids consumption in 1Q20 by almost 900Mbbls/d from the January estimate. This is a result of the coronavirus impact, along with a milder than usual January. This takes the EIA’s annual consumption growth forecast over 2020 to 1.02MMbbls/d, down from a 1.34MMbbls/d estimate in January. Finally, the EIA also revised lower its US crude oil output growth estimates for 2020 and 2021 to 960Mbbls/d and 350Mbbls/d respectively.

Metals

Base metals along with other risk assets rebounded sharply yesterday, while precious metals halted their upward move, as the number of suspected and confirmed cases for the coronavirus both declined from the previous day. Meanwhile, there were reports that the Chinese government hinted at additional financial support in its continuing efforts to combat the virus.

For ferrous metals, iron ore futures rose sharply with SGX’s most active contract trading to around US$85/t pulled up by the overall optimism in the metals markets. Prices were also supported as Vale, in its latest quarterly update trimmed production estimates for the first quarter of 2020 due to continued suspension of tailing disposals at the Laranjeiras dam and heavy rain disruptions. Vale lowered production estimates for iron ore to 63-68mt in 1Q20, compared to previous estimates of 68-73mt. Despite this, the company has kept its full-year guidance for 2020 unchanged at 340-355mt, although volumes will depend largely on the granting of approvals to restart suspended production. Iron ore output for the quarter ending in December stood at 78.3mt, down 9.6% QoQ and 22.4% lower YoY. Full-year 2019 output totalled 302mt, down sharply from 385mt in 2018, reflecting the dam disaster seen in early 2019.

In terms of consumption, the near term outlook remains fragile, with the rising possibility of production curtailments by steel mills as per the updates from Hebei Metallurgical Industry Association. Steel output, which is estimated to have remained flat in January, might fall this month if China fails to contain the virus. Steel mills are currently dealing with a number of non-supportive factors, such as rising inventories, labour issues, raw material shortages and slowing sales. Given the current environment and poorer downstream demand, it is difficult to be constructive on raw material prices.

Agriculture

While much of the industry is in the Middle East for the Dubai Sugar Conference, the sugar market continues to strengthen, trading to an intraday high of USc15.46/lb yesterday, levels last seen back in late 2017. As widely anticipated the global sugar market was set to return to deficit this year, and as a result should be broadly supportive for prices. However, the scale of the strength has surprised many, with poorer crops from Thailand and India increasing the deficit outlook. The tightness in the prompt market is also reflected in the March/May raws spread which has traded to a backwardation of USc0.37.lb. This compares to a contango of around USc0.10/lb at the start of the year. Meanwhile, early expectations for the 2020/21 season are that we could see another year of deficit, however much of this will depend on how the CS Brazil sugar industry respond to the higher sugar price environment currently. If this strength continues into April, the Brazilian industry is likely to shift sugarcane back towards sugar production, rather than ethanol.

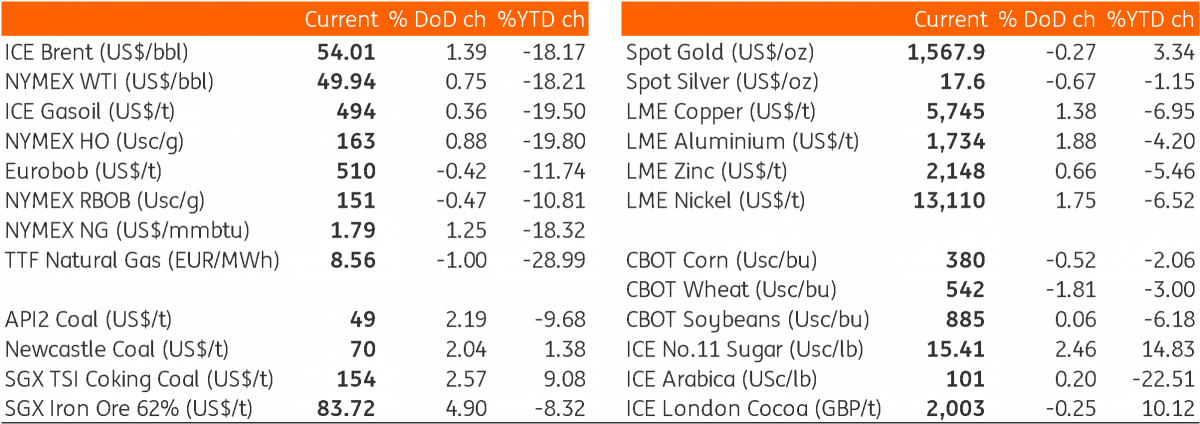

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap