The Commodities Feed: Crude draws & product builds

Your daily roundup of commodity news and ING views

Energy

Oil prices got another boost higher yesterday, with Brent settling above US$35/bbl. Signs of an improving physical oil market have clearly been supportive. Meanwhile the EIA report yesterday was also fairly supportive, showing that US crude oil inventories fell for a second consecutive week, declining by 4.98MMbbls. Stocks at Cushing fell by a record 5.59MMbbls.

While changes on crude were fairly supportive, refined products were less so. Gasoline and distillate fuel oil inventories increased by 2.83MMbbls and 3.83MMbbls respectively. This has put downward pressure on both of the product cracks. An increase in refinery utilisation rates over the week would have contributed to these builds, whilst demand for both was weaker, with gasoline demand (product supplied) falling back below 7MMbbls/d.

According to Reuters, Russian oil and condensate output over the first 19 days of May averaged 9.42MMbbls/d, down from 11.35MMbbls/d in April. Given that condensate output is not included in the OPEC+ deal, and given that Russian condensate output is reportedly in the region of 700-800Mbbls/d, it means that oil output would be in the region of 8.6-8.7MMbbls/d, which is still above their agreed production quota of 8.5MMbbls/d.

Metals

Gold prices along with other precious metals continued to trade higher yesterday, with spot gold trading around the US$1750/Oz level. Safe-haven appeal continues to see ETF holdings in gold edge higher, with them currently standing at a little over 99moz, an increase of 3moz since the start of the month, and up around 16moz since the start of the year.

The latest data from the IMF shows that Turkey expanded its gold reserves for a fourth straight month by 1moz, to a record 20.4moz in April, while, Russian gold holding remained unchanged at 73.9moz in April. This is aligned with comments that Russia's central bank would suspend gold purchases. However, Kazakhstan saw gold holdings fall by 0.13moz over the month to total 12moz in April.

Finally, the International Aluminium Institute (IAI) released production numbers yesterday, which showed that daily global primary aluminium output fell 0.6% MoM in April to average 175.2kt. Daily output for the same month last year was 174.7kt. China daily average production was down 0.6% MoM, although up 0.7% YoY to stand at 99.3kt in April. Production elsewhere in Asia (ex-China) declined by 8.3% YoY and 1.1% MoM.

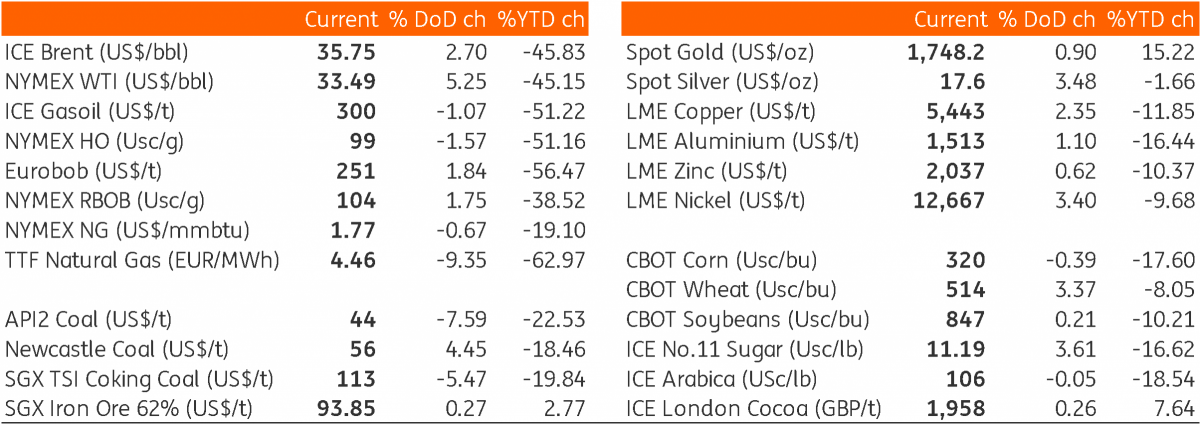

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap