The Commodities Feed: Copper spreads tighten

Your daily roundup of commodity news and ING views

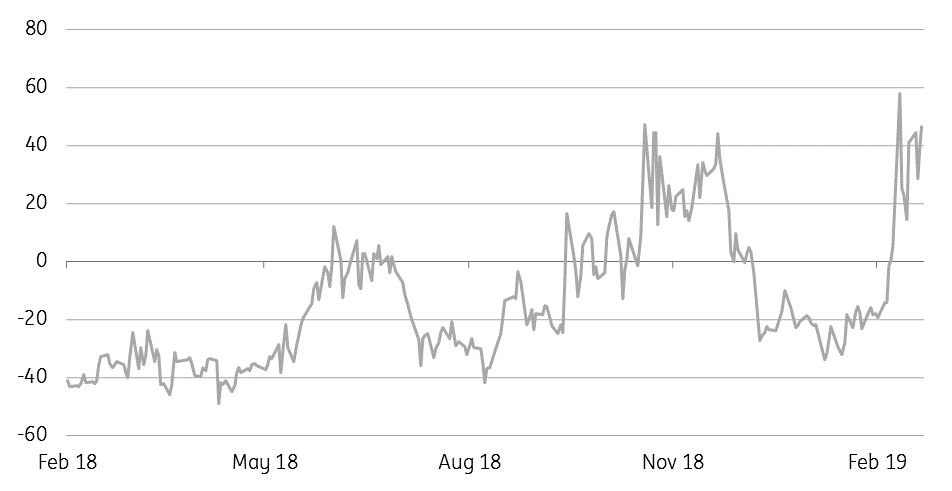

LME Copper cash/3m spread strengthens (US$/t)

Energy

US monthly crude oil production: The latest monthly data from the EIA shows that US crude oil production averaged 11.85MMbbls/d over December, which was a 0.5% decline from November, and is in fact the first month-on-month fall in US output since May. The decline was driven by Gulf of Mexico offshore production, which fell by 125Mbbls/d over the month. Production in Texas increased by 35Mbbls/d over the month to average 4.88MMbbls/d.

Separately, the Department of Energy announced yesterday that it will sell up to 6MMbbls of sweet crude from the Strategic Petroleum Reserve (SPR), with deliveries planned for April and May. This SPR release is part of the planned modernisation programme, and so the reason the market largely ignored the news.

Product inventories: The latest data from PJK International shows that refined product inventories in the ARA region declined by 187kt over the last week to total 5.27mt. Fuel oil saw the biggest decline, with stocks falling by 72kt over the week. Fuel oil cracks in Europe remain firm, having traded to less than a US$3/bbl discount in recent days. European values are being pulled higher by the strength seen in the Asian market.

Metals

Copper spread strength: The LME copper cash/3m spread remains fairly strong, currently trading at a US$46.50/t backwardation –quite the move when you consider the spread was at more than a US$30/t discount over parts of January. The strength in the spread ties in with the view of a tighter refined market, evident when looking at LME inventories, which have fallen from around 150kt in early February to a little over 128kt at the moment.

Agriculture

Global cocoa market balance: The International Cocoa Organization estimates that the global cocoa market will see a surplus of 39kt over the 2018/19 season, compared to a surplus of just 9kt in the 2017/18 season. The growing surplus comes despite expectations that grindings will increase by 2.6% over the season, with the increase driven by strong production from the Ivory Coast- output from the country is estimated at 2.15mt.

Mar-19 raw sugar expiry: The no.11 Mar-19 raw sugar contract expired yesterday at a USc0.05/lb discount to the May contract, with reports suggesting that around 1mt of sugar was delivered into the tape. Early reports suggest that Louis Dreyfus took delivery of around 635kt, whilst Sucden received somewhere in the region of 400kt. The ICE exchange will release the delivery notice later today, which will give full expiry details.

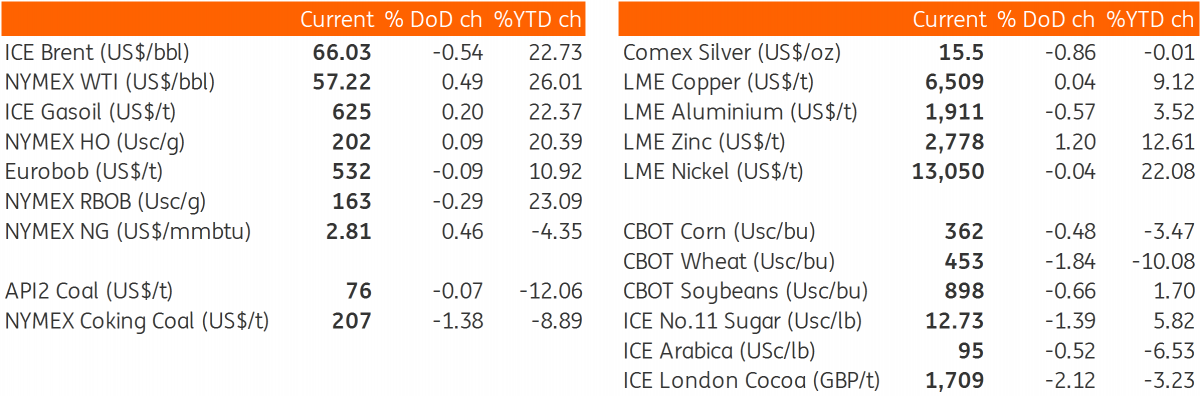

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap