The Commodities Feed: Copper smelter delays persist

Your daily roundup of commodity news and ING views

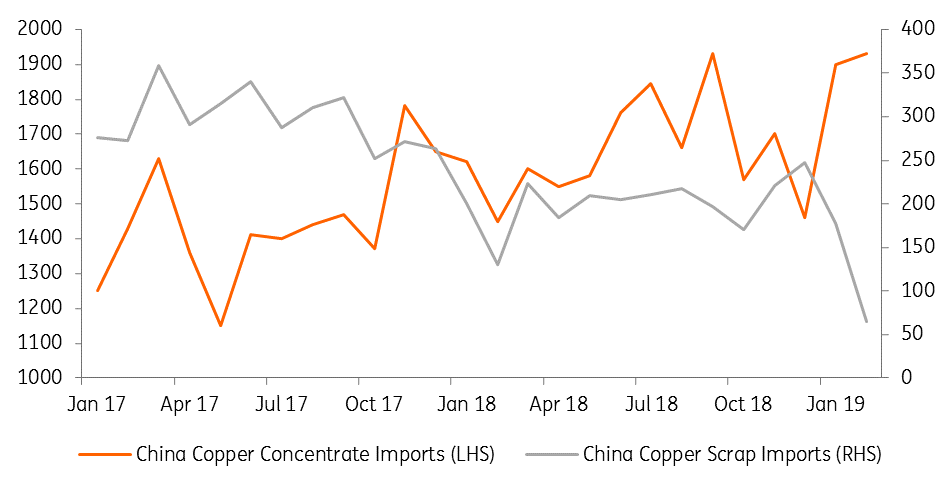

Chinese copper concentrate imports vs. copper scrap imports (k tonnes)

Energy

US crude oil inventories: The API is scheduled to release its weekly inventory report later today, and market expectations- according to a Bloomberg survey- are that US crude oil inventories declined by 3MMbbls. Drawdowns are expected in both gasoline and distillate fuel oil as well. US gasoline inventories have been in decline since early February, which has proven supportive for gasoline cracks after a poor performance at the start of the year.

Delays in shipping as a result of the Houston Ship Channel closure may have an impact on the import/export numbers, however this is more likely to be reflected in the numbers released next week.

OPEC+ April meeting: OPEC+ members have officially agreed to cancel their meeting which was scheduled for April. This would see the next official OPEC+ meeting take place in Vienna on 25-26 June, whilst the Joint Ministerial Monitoring Committee will meet in Saudi Arabia in May. The cancellation of the meeting could suggest that all members are not in agreement to extend the current deal which is set to last until the end of June. If this is the case, it is likely that it is Russia who is not convinced that an extension to the deal is needed.

Metals

Copper smelter delays: The restart of the Chuquicamata smelter in Chile could be delayed further. The smelter is running behind schedule and Codelco has now removed the main contractor in charge of constructing two acid plants at the smelter. Codelco will complete the upgrade itself, with the first acid plant scheduled to be operational by the second half of April and the second acid plant 15-20 days later. Meanwhile, treatment and refining charges for imported copper in China dropped further to US$68-73/t and US¢6.8-7.3/lb compared to US$70-75/t last week and US$90-95/t at the start of the year, as Chinese smelters increase demand for copper concentrate.

This was reflected in Chinese trade data which showed that smelters in the country imported 1.93mt of concentrate in February, which matches the record volume of concentrate that was imported in September. With the Chinese government cracking down on scrap imports, Chinese smelters appear to be filling the void with increased concentrate volumes.

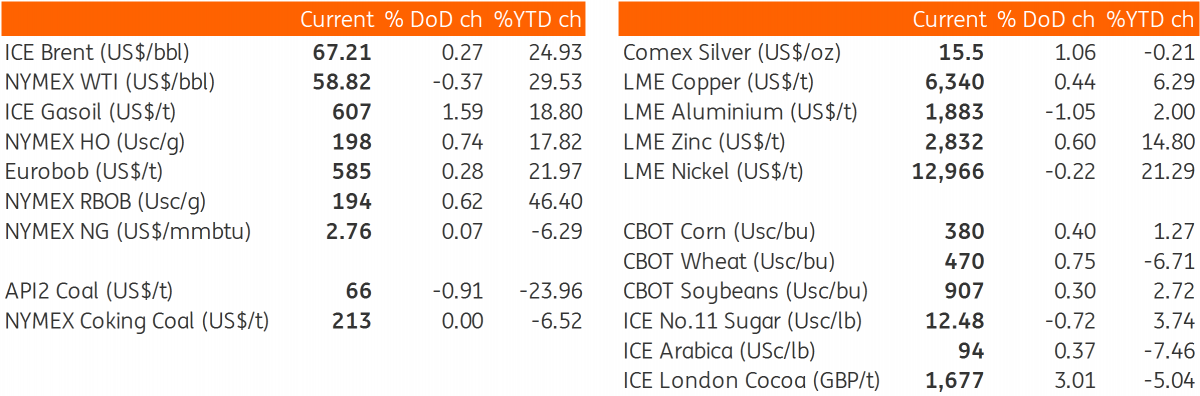

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap