The Commodities Feed: Chinese oil imports hit a record

Your daily roundup of commodity news and ING views

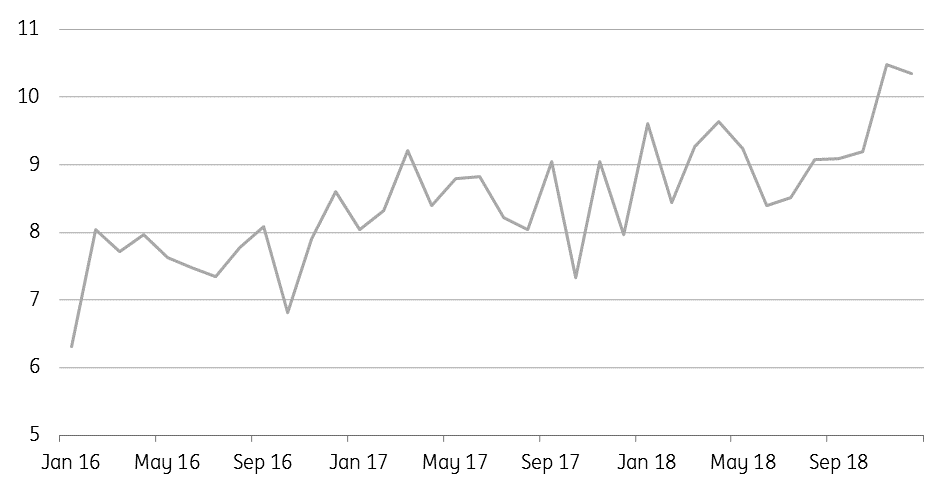

Chinese crude oil imports (MMbbls/d)

Energy

OPEC+ cuts: Saudi Energy Minister Khalid al-Falih reaffirmed over the weekend that he believes that OPEC+ has taken enough action to balance the oil market this year. He also mentioned that Russian cuts have started slower than what he would have liked. According to the Russian Energy Minister, output in the country is now more than 30Mbbls/d lower than October levels, and will be 50Mbbls/d lower over January- this is some distance away from the 228Mbbls/d cut that Russia agreed to. Russia has always insisted that reductions would be gradual, much like we saw when the previous output cut deal started in 2017.

Chinese crude oil imports: Latest trade data from China shows that the country imported 10.35MMbbls/d over the month of December, down from 10.47MMbbls/d in November, but up from 7.97MMbbls/d in December 2017. Imports over the full year increased by a little over 10% YoY to average a record 9.28MMbbls/d over 2018. In the near term, we may see this strong growth slow, given that the first batch of import quotas for independent refiners is lower than the first batch seen in 2018.

Metals

Chinese metals trade: Latest customs data shows that China’s imports of refined copper fell 4.7% YoY (down 6.7% MoM) to 429kt in December; although imports for the full year were up 13% YoY, hitting another record high of 5.3mt. Healthy demand for wiring metal and restrictions on scrap imports helped to increased demand for refined imports. Looking forward, scrap import rules are tightened further, which should support copper imports; although economic headwinds may keep demand growth relatively modest. For other metals, iron ore imports increased 3% YoY to 86.65mt in December, however full year imports were down 1% YoY to 1.06bn tonnes. On the export front, semi-fabricated aluminium exports remained above 500kt over December, coming in at 527kt. Meanwhile full year exports were up 21% YoY, to total 5.8mt.

Gold buying: ETF investors bought 24,850oz of gold on Friday, while since the start of the year gold ETF holdings have increased by 787,825oz. With total known ETF holdings of gold standing at 71.85mOz, we are fairly close to the record high of 72mOz seen in May 2018. Risk averse sentiment, a weaker dollar and growing expectations of slower Fed rate hikes in 2019 has been supportive for gold prices.

Agriculture

Chinese soybean imports: Latest trade data from Chinese customs shows that the country imported 5.72mt of soybeans over December, up 6.3% MoM, but still down 40% YoY. Meanwhile imports for the full year totalled a little over 88mt, down from 95.5mt in the previous year. The slowdown in imports clearly reflects the impact from the ongoing trade war between the US and China, whilst an outbreak of African swine fever is certainly not helping. How imports perform moving forward is going to largely depend on how trade talks develop.

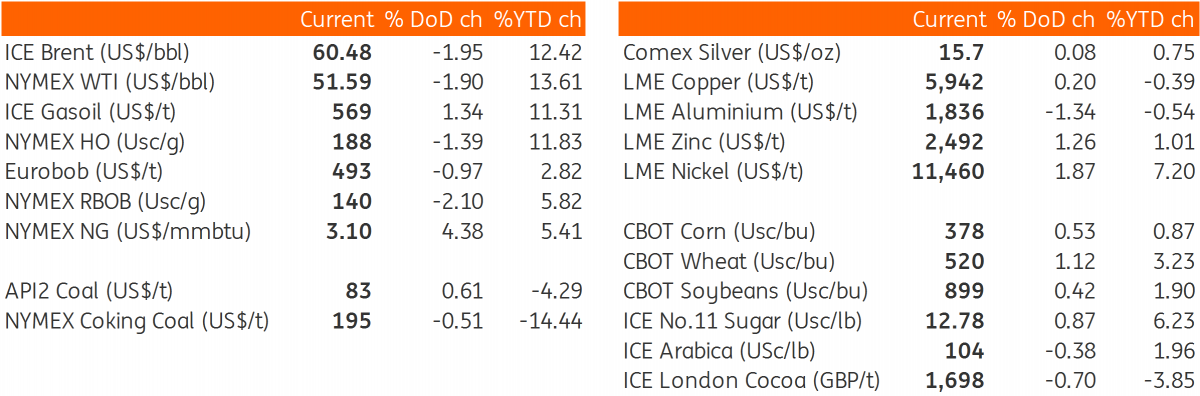

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap