The Commodities Feed: China opens down

Your daily roundup of commodity news and ING views

Energy

ICE Brent has now fallen almost 15% since the start of the Lunar New Year holidays, with the market getting increasingly worried over the demand impact from the outbreak of the Coronavirus. Brent is trading sub-US$ 56/bbl - levels last seen in early January 2019, and which will get OPEC+ increasingly worried, possibly forcing them to take further action to balance the market. There were plenty of media reports last week that OPEC+ were discussing bringing forward their extraordinary meeting from early March to February as a result of the price weakness. However, so far, nothing has been confirmed. This week though, the OPEC+ Joint Technical Committee will discuss the impact of the virus on oil markets, according to reports.

Clearly travel restrictions and the extended shutdown of large parts of the Chinese industrial sector have weighed on oil demand and this is reflected in the weakness that we are seeing in the ICE Brent time spreads. The April/May spread has fallen from a backwardation of US$0.75/bbl in early January to just US$0.08/bbl currently, suggesting that the tightness in the oil market is easing. This shouldn’t come as too much of a surprise, with reports of fuel storage tanks in China nearing capacity, which would likely force refiners in the country to cut run rates if we do not start to see a recovery in demand. Bloomberg reports that oil demand in China has fallen by around 20% currently, which would be equivalent to about 3MMbbls/d. While this does sound significant, averaging the number out over the quarter makes the impact look less severe.

Moving onto investor flows, and speculative longs have been heading for the exits with the speculative net long in ICE Brent falling by 26,633 lots over the last reporting week. This still leaves leave them with a net long of 402,357 lots. Though given the price weakness seen since last Tuesday, we are likely to have seen further considerable liquidation since then. Meanwhile, NYMEX WTI saw substantially more liquidation, with speculators selling 56,489 lots over the reporting week to leave them with a net long of only 175,700 lots.

Metals

After the substantial sell-off on the LME over the last week, participants will be watching closely as the SHFE market reopens following the Lunar New Year holiday. The domestic market will have to play catch-up with the recent price action seen on the LME. Unsurprisingly SHFE copper opened under significant pressure, trading limit down, and down more than -6% at the time of writing. It was a similar story with ferrous metals, with iron ore, rebar and HRC all down by more than 7%.

Prior to the outbreak, the demand outlook was looking more constructive, with the China manufacturing PMI returning to expansionary territory. Clearly the latest developments have derailed that, with many downstream players in the metals industry postponing restarts. Units of State Grid Corporation of China have already delayed some purchase tenders for copper, which is clearly not a positive sign for metal markets. Disruptions to logistics are also largely as expected, and there are reports that some ports have extended demurrage periods. As China returns from Lunar New Year holidays this week, markets will get a much better idea of the full scale of disruptions.

However, we think that supply-side risks are also rising along the supply chain. Firstly, while production remained largely normal over the Lunar New Year period, logistical disruptions could mean that metal stocks are building at producers, with them unable to move further down the supply chain. Secondly, we’ve heard that some alumina smelters are facing the risk of fuel gas shortages; meanwhile primary smelters are running low on alumina, as well as carbon anode. There are reports that smelters are having to pay a higher premium on alumina deliveries in order to avoid delays. Further disruptions in supply chains, along with low stock levels on SHFE, could offer some support to the market, despite the bleak demand outlook in the short term.

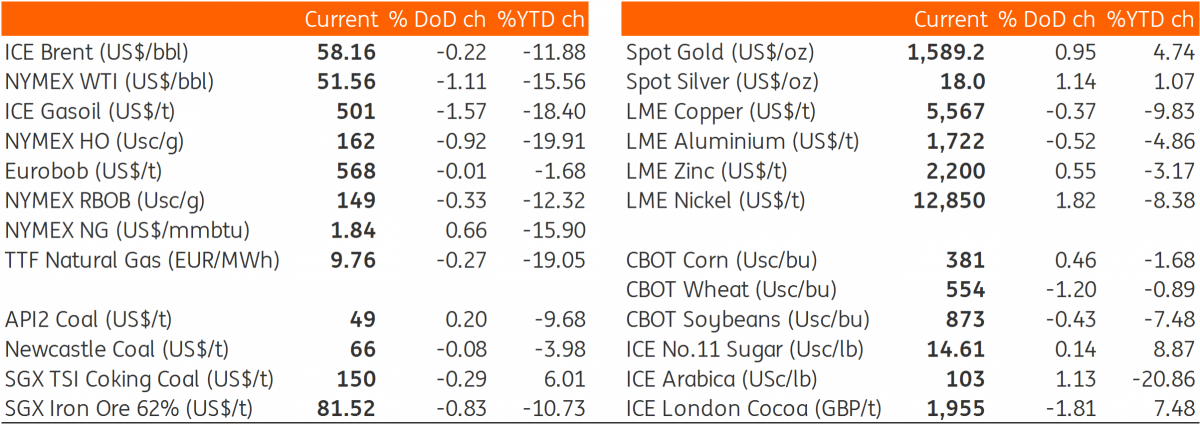

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap