The Commodities Feed: China buys US soybeans

Your daily roundup of commodities news and ING views

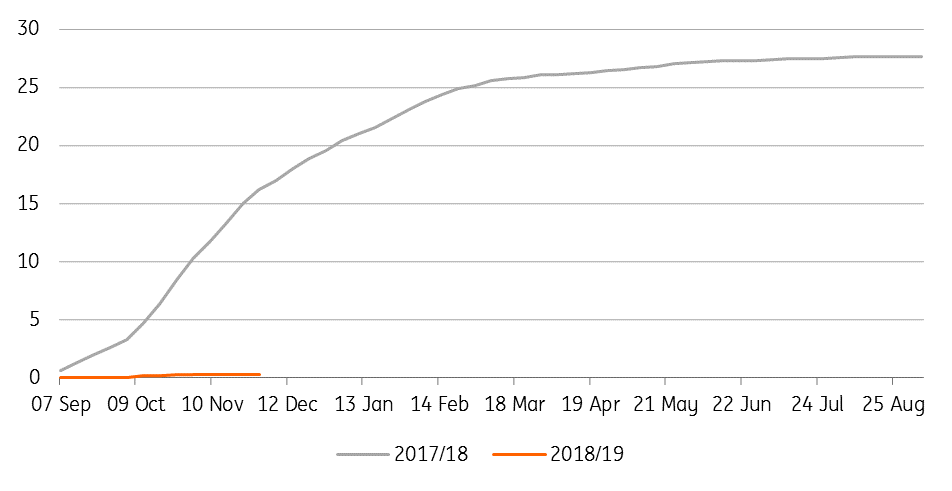

US soybean export sales to to China (m tonnes)

Agriculture

China buys US soybeans: According to the US Soybean Export Council, China has bought between 1.5-2mt of US soybeans in recent days, which follows constructive trade talks between China and the US at the G-20 summit. This development is clearly positive for US farmers, however, we would need to see significantly more purchases from China, with cumulative export sales to China since the start of this marketing year through to the end of November totalling just 339kt, down from 16.26mt at the same stage last season.

Energy

OPEC report: OPEC released its monthly report yesterday, which showed that the group’s production averaged 32.97MMbbls/d in November, down 11Mbbls/d from October levels. Unsurprisingly the biggest increase over the month came from Saudi Arabia, with output increasing by 377Mbbls/d, and surpassing 11MMbbls/d. Meanwhile, Iran saw its output fall by 380Mbbls/d to 2.95MMbbls/d. In the report, the group also marginally revised their estimate higher of non-OPEC supply in 2019 (increases estimated over 2H19), taking their estimate of non-OPEC supply to 62.09MMbbls/d, whilst they left their total demand estimate unchanged at 100.08MMbbls/d for 2019. Their numbers suggest that OPEC may need to make further cuts over 2H19.

US crude oil inventories: The EIA yesterday reported that US crude oil inventories declined by 1.21MMbbls over the last week, which was less than the 10.2MMbbls reduction that the API reported, and less than the 3.5MMbbls that the market was expecting. After being a net exporter of petroleum in the previous week, last week the US returned to becoming a net importer. US crude oil exports fell 929Mbbls/d over the week, from a record 3.2MMbbls/d in the previous week. Meanwhile, crude oil imports increased by 174Mbbls/d to average 7.39MMbbls/d over the week. Finally, the EIA also reported that gasoline inventories increased by 2.1MMbbls over the week, while distillate fuel oil inventories declined by 1.48MMbbls. This continues to leave gasoline inventories towards the five-year high, while the distillate fuel oil market remains tight, with inventories remaining below the 5-year average.

Metals

Chile copper mine strike: Chile is witnessing further industrial action, with workers at Codelco’s 265ktpa Chuquicamata copper mine going on strike and blocking access to the mine. This is the third time in less than a month that Chilean mine workers have protested. Codelco’s Radomiro Tomic mine and BHP’s Spence mine saw brief walkouts recently. Meanwhile, LME copper inventories fell by 1,400 tonnes yesterday, the 11th consecutive decline, pushing total stocks to a decade low of 119.9kt. The LME cash/3M spread remains in backwardation, although has weakened quite considerably since late November.

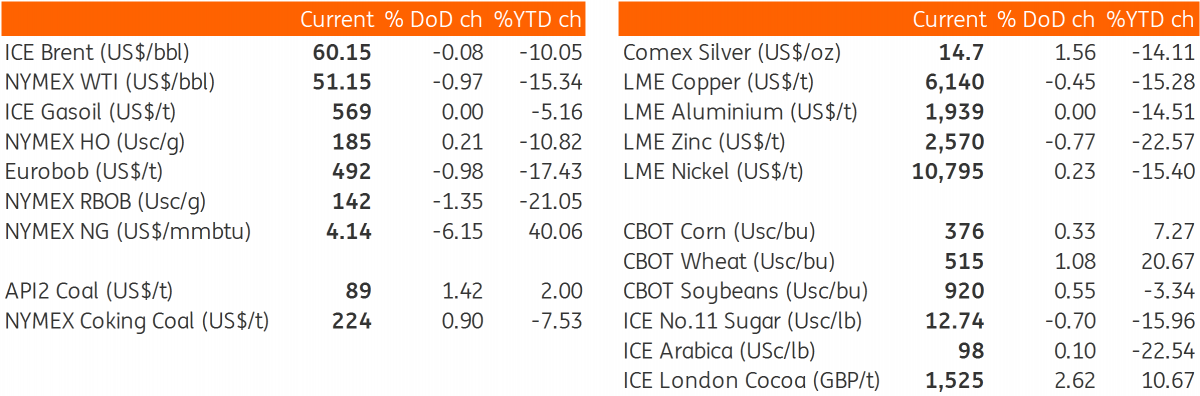

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

CommoditiesDownload

Download snap