The Commodities Feed: API reports a big draw

Your daily roundup of commodities news and ING views

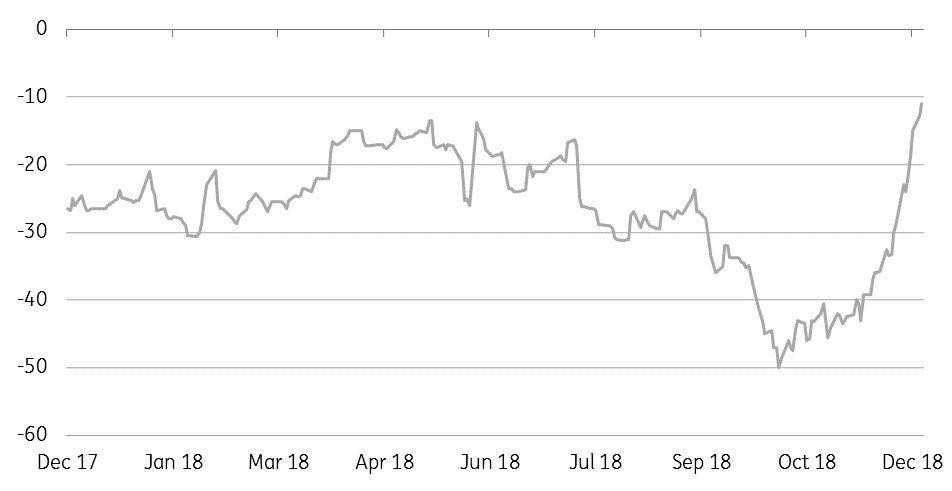

West Canada Select discount to WTI narrows (US$/bbl)

Energy

US crude oil inventories: The EIA released its latest Short Term Energy Outlook yesterday, where they left their 2018 and 2019 US oil production forecast largely unchanged at 10.9MMbbls/d and 12.1MMbbls/d, respectively. This was followed by the API’s weekly inventory numbers, which showed that US crude oil inventories fell by 10.2MMbbls over the last week. This compares to market expectation of a 3.5MMbbls decline, according to a Bloomberg survey. Meanwhile, API numbers also showed that gasoline inventories fell by 2.48MMbbls, whilst distillate fuel oil stocks increased by 712Mbbls. The EIA will release its weekly report later today, while OPEC will also be releasing its monthly oil market report today. This will be followed by the IEA’s oil market report tomorrow.

West Canada Select strengthens: The WCS discount to WTI continues to narrow, with the spread now at just a US$11/bbl discount, which are levels last seen back in 2017. It has been an amazing move, particularly when you consider that the spread was trading at a US$50/bbl discount in early October. The latest strength in WCS has been a result of Alberta’s Premier announcing that producers in the province would cut oil production by 325Mbbls/d until domestic inventories are back towards more normal levels.

Metals

US aluminium capacity: According to a report by the Economic Policy Institute, the US aluminium industry is already seeing positive effects from trade tariffs, with three smelter restarts and one smelter expansion totaling 663ktpa. The Institute also expects US aluminium production to have grown by 67% (500ktpa) between 2017 and the end of 2018.

Agriculture

WASDE report: The USDA released its latest WASDE report yesterday, and there were no significant changes to the agency’s estimates. For corn, the USDA revised slightly higher 2018/19 ending stocks from 307.51mt to 308.8mt, with some upward production revisions to the EU and Ukraine. For wheat, global ending stocks for the 2018/19 season were revised from 266.71mt to 268.1mt, with a revision higher in beginning stocks. For soybeans, global ending stocks for the 2018/19 season were increased from 112.08mt to 115.33mt, as a result of the agency revising their Brazilian soybean production estimate from 120.5mt to 122mt.

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap