The Commodities Feed

Your daily roundup of commodities news and ING views

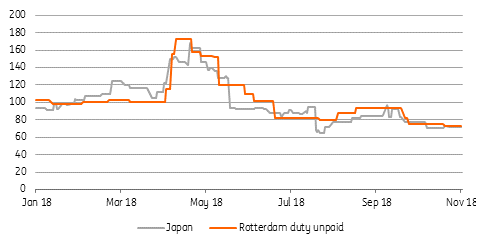

Aluminium spot premium (US$/t)

Energy

US crude oil inventories: The API reported yesterday that crude oil inventories increased 3.45MMbbls over the last week, compared to market expectations for a build of around 1MMbbls. The EIA is set to release its weekly numbers later today, and if the numbers are aligned with the API, it would be the tenth consecutive week of crude oil builds- a factor which has certainly not helped market sentiment. On the refined products side, the API reported a gasoline draw of 2.62MMbbls and a distillate fuel oil build of 1.19MMbbls.

Russian oil output: Bloomberg reports that Russian oil output so far over the month of November is 40Mbbls/d lower from October levels. Output last month averaged a record 11.41MMbbls/d, considerably higher than the 10.97MMbbls/d the country was producing back in May this year. Meanwhile, there is still plenty of uncertainty over where the Russians stand with potential production cuts over 2019.

Metals

China winter cuts: Winter capacity cuts are underway, with the Shandong local government ordering China Hongqiao Group to shut around 550kt pa of aluminium smelting capacity in the province between the 15 November and 15 March. The group has also been ordered to shut 2mtpa of alumina capacity over the period. In recent months, China has become a bigger supplier of alumina to the international market and these cuts will only tighten what is an already tight market.

Japanese aluminium premium: Discussions for 1Q19 aluminium premiums are currently underway, and so far Japanese buyers have been offered a premium of US$91/t, down from US$103/t for the current quarter. This would be more aligned with the weakness that we have seen in spot premiums.

Agriculture

CS Brazil sugar output: The latest data from industry body UNICA shows that mills in CS Brazil crushed 21.3mt of sugarcane over the first half of November, down by more than 9% year-over-year. Sugar production over the fortnight totalled 880kt, down almost 30% YoY, with mills continuing to favour ethanol production over sugar. The cumulative cane crush for the 2018/19 season stands at 529.7mt, down by 4.6% YoY, whilst cumulative sugar production so far totals 25.23mt, down almost 27% YoY.

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

CommoditiesDownload

Download snap