The Commodities Feed

Your daily roundup of commodities news and ING views

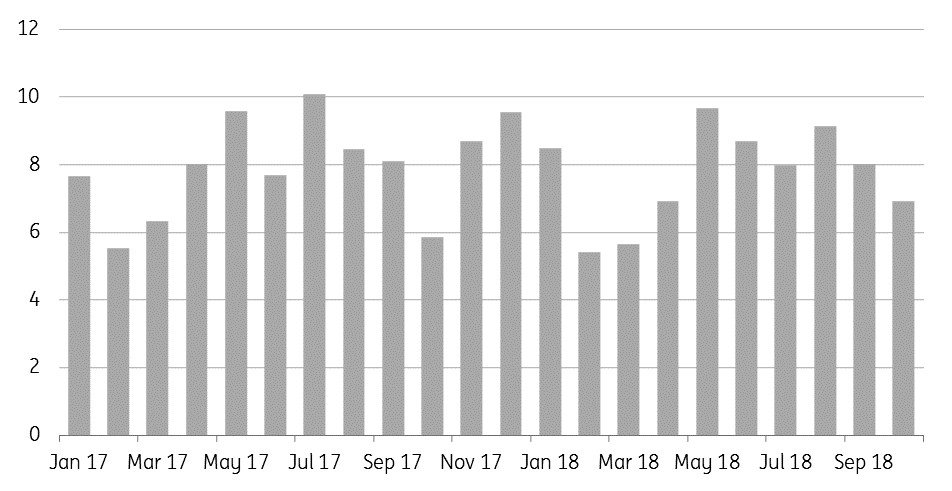

Chinese soybean imports (m tonnes)

Energy

Saudis pump more: The Saudi Energy Minister, Khalid Al-Falih, has said that the Kingdom is producing more than 10.7MMbbls/d so far this month, which is near to what they produced over October. However, the minister insisted that they will not oversupply the market, shipping only where there are customer needs. The Saudi’s previously said that December exports would fall by 500Mbbls/d month-on-month, and now expect January loadings to be even lower.

ARA product inventories: The latest data from PJK International shows that product inventories in the ARA (Amsterdam, Rotterdam and Antwerp) region increased by 67k tonnes over the week to total 4.95mt. The increase was driven by a 124kt build in fuel oil stocks and a 71kt increase in gasoline inventories. This keeps gasoline inventories at the five-year high. Meanwhile, gasoil inventories saw a decline off 113kt over the week, and inventories continue to edge towards the five-year low.

Metals

Nickel under pressure: SHFE nickel fell 1.4% yesterday, and is under further pressure this morning, with trade concerns continuing to linger, whilst a softer stainless steel market has only added further pressure. On the supply side, the expected ramping up of nickel pig iron production in Indonesia has not helped sentiment. LME nickel prices have fallen almost 6% since the start of the month, and over 30% since their peak in June. The spreads also suggest little tightness in the market, with the cash/3M spread in a $67.75/t contango.

Iron ore prices weaken: Iron ore prices have come under pressure recently, falling from a recent peak of US$75.64/t to US$73.40/t currently. This weakness appears to be driven by the fall we have seen in steel margins, which have fallen below CNY200/t after having been as high as CNY1,000/t prior to the summer.

Agriculture

Chinese soybean imports: The latest customs data from China shows that the country imported 6.92mt of soybeans over the month of October, down 14% month-on-month, however up 18% year-on-year. As of yet, trade tariffs on US soybeans seem to be having little impact on total Chinese soybean imports, with year-to-date imports standing at 76.93mt, down just 0.5% YoY.

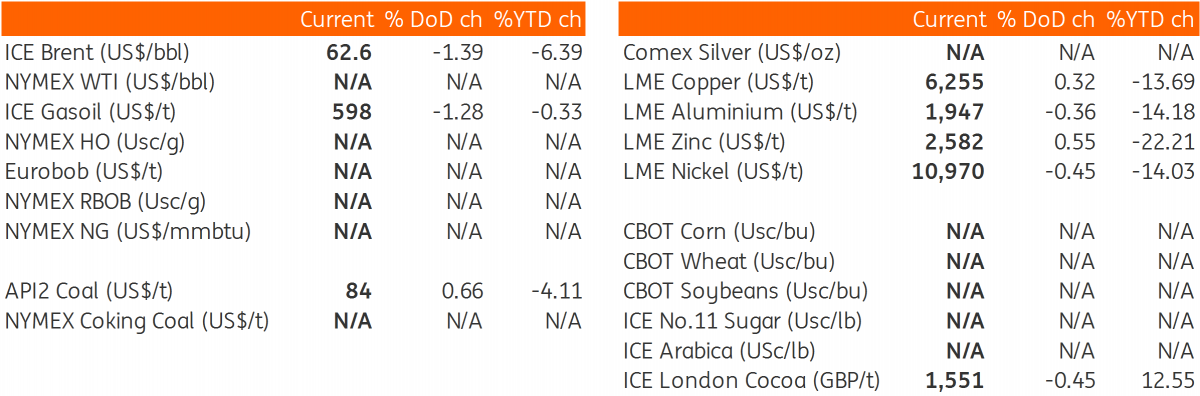

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

CommoditiesDownload

Download snap