The Commodities Feed

Your daily roundup of commodities news and ING views

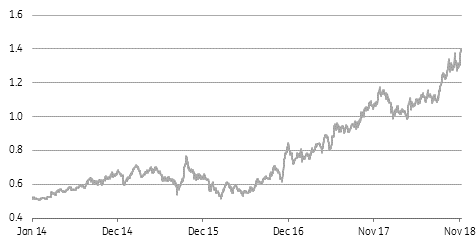

Palladium/ platinum price ratio continues to edge higher

Energy

Crude oil speculative positioning: The latest data shows that speculators have continued to reduce their net long positions in ICE Brent, with speculators selling 45,216 lots, leaving them with a net long of 214,832 lots as of last Tuesday. This is the smallest net long they have held since June 2017. However the gross long, which stood at 304,917 lots at the end of the reporting period, is the smallest gross long since 2015. The long/short ratio suggests that speculators hold a fairly neutral position, with 3.38 longs for every short, this compares to in excess of 20 earlier in the year.

OPEC+ cuts: There has been further noise around potential OPEC+ production cuts over 2019, with the Russian Energy Minister saying this morning that the group has not made any decision yet, with the market situation over November and December needing to be assessed. Market expectations continue to grow that OPEC+ will agree to cut production at their meeting in early December by anywhere between 1-1.4MMbbls/d.

Metals

Metal speculative positioning: It was another week of speculative selling across the metals complex. The managed money net short for gold nearly doubled from 37,486 lots to 70,864 while for silver, it jumped from 20,334 lots to 38,846. The managed money net short position in COMEX copper increased from 2,200 lots to 7,722 lots as of last Tuesday. The bulk of this move over the last week was driven by fresh shorts rather than longs liquidating.

Palladium strength: Palladium prices continue to edge higher, with the market rallying more than 7% over the last week to trade at a new all-time high. Robust demand from China, as a result of stricter emission standards has meant a tighter global market. Speculators have increased their net long position in the metal over recent months from basically flat in August to 12,837 lots as of last Tuesday. However, speculators are still some distance away from the 27,471 lots they held back in January.

Agriculture

Speculators reduce sugar long: The latest CFTC data shows that speculators reduced their net long in No.11 sugar by 33,341 lots, leaving them with a net long of 35,342 lots as of last Tuesday. The reduction was driven fairly evenly by longs liquidating along with fresh shorts. Moving forward, and as we enter the peak of the Indian sugar harvest, and this sugar makes its way onto the world market, we could see further speculative liquidation. However, this assumes that there is no significant downside surprises to the Indian crop.

Chinese anti-dumping investigation: China has decided to start an anti-dumping investigation into Australian barley. This follows complaints from China’s Chamber of International Commerce, which has said that Australian barley has been sold into the domestic market below normal prices for the last 12 months. China is by far the largest destination for Australian barley, whilst Australia is also the largest supplier to China- making up almost three quarters of total imports.

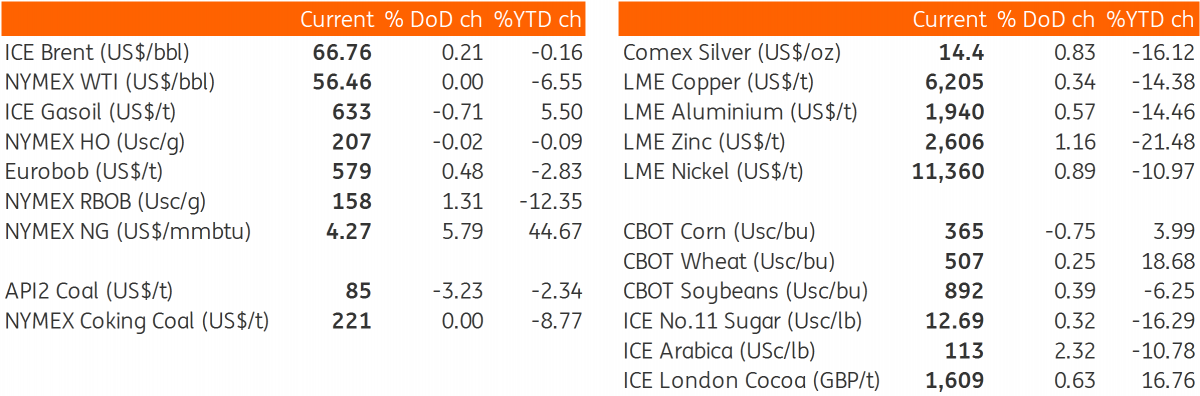

Daily price update