The Commodities Feed

Your daily roundup of commodities news and ING views

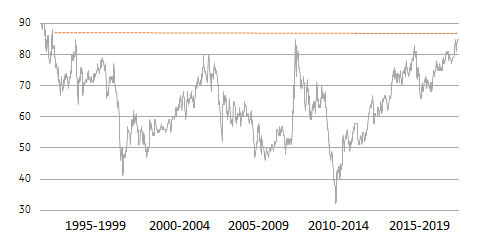

Gold/ Silver ratio hits levels last seen in 1993

Energy

The oil sell-off continues: Downward pressure on the oil complex continued yesterday, with WTI finishing the day more than 7% lower, whilst Brent wasn’t too far behind. The initial catalyst for the move was President Trump’s oil tweet, and this was followed by the release of OPEC’s monthly oil report, which showed the group revising lower their demand growth forecasts for both 2018 and 2019 once again. Negative sentiment may persist, with the IEA set to release its monthly oil market report this morning- the market will be watching closely for any revisions lower to their demand growth forecasts. While later today, the API is set to release weekly US inventory numbers, and the market is expecting a crude oil build of 3.25MMbbls over the last week.

Natural gas spikes higher: While the sell-off in crude oil has grabbed all the headlines, the rally in Henry Hub natural gas has gone largely unnoticed. Natural gas rallied by more than 8.2% yesterday, taking Henry Hub above US$4/MMBtu for the first time since 2014. Heading into winter, US natural gas inventories are well below the five-year low, while colder weather has only added to the bullishness.

Metals

Chinese steel output: The latest metals production data from China shows continued growth. Steel output over October increased by 9.1% year-on-year to a record 82.55mt. Mills would have tried to increase throughput rates as much as possible ahead of winter capacity cuts. Furthermore, whilst producer margins have come under pressure more recently, they are still at fairly attractive levels.

Gold/silver ratio strengthens: Silver continues to weaken relative to gold, with the gold/silver ratio edging closer towards 86, and is in fact at the highest levels seen since 1993. Concerns over trade tensions and what this means for global growth appears to be what is weighing on silver prices, given the large industrial usage of the precious metal relative to gold.

Agriculture

US grain export inspections: The latest data from the USDA shows that 1.14mt of corn was inspected for export over the last week, this compares to 1.28mt in the previous week. Meanwhile, total inspections so far in the season total 11.11mt, up from 5.96mt at the same stage last year. Turning to soybeans, and export inspections picked up over the week- totalling 1.3mt, compared to 1.24mt in the previous week. However cumulative export inspections so far this season still remain well behind last season, with them standing at 9.91mt- 72% lower year-on-year. The strange trend of Argentina importing US soybeans continued, with 249,278 tonnes of US soybeans inspected for export set to make its way to Argentina.

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

CommoditiesDownload

Download snap