The Commodities Feed

Your daily roundup of commodities news and ING views

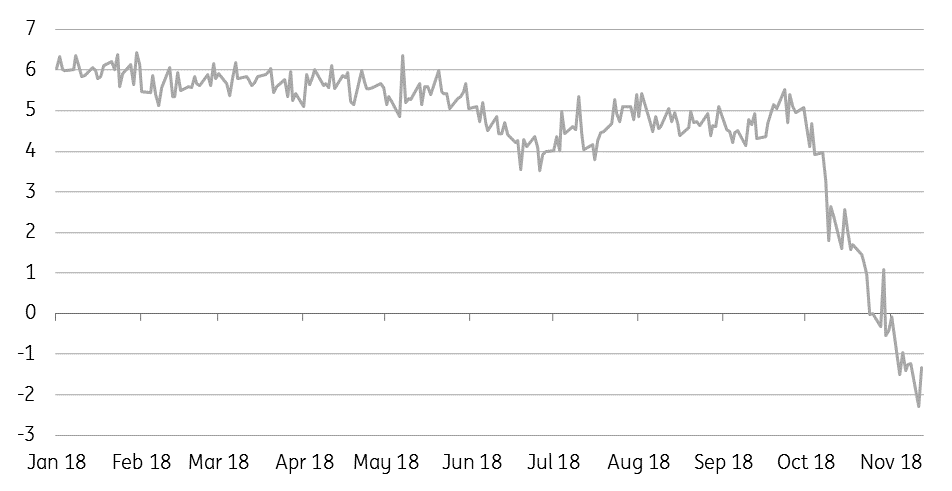

Jan'19 Eurobob crack (US$/bbl)

Energy

Trump weighs in on potential OPEC cuts: In response to OPEC looking at potential production cuts, President Trump yesterday tweeted “Hopefully, Saudi Arabia and OPEC will not be cutting oil production. Oil prices should be much lower based on supply!”. This tweet certainly did not help prices, with WTI settling lower yesterday, and the downward pressure on both Brent and WTI has continued this morning. Given the growing global surplus over the first half of 2019, OPEC will likely try to ignore President Trump’s call as much as possible. Meanwhile later today, OPEC will release its monthly oil market report.

Gasoline weakness: Gasoline cracks remain under pressure, particularly in Europe, where they are in fact negative- the Eurobob crack has traded to a discount of over US$2/bbl recently. Gasoline inventories in both the US and the ARA region in Europe remain above the five-year high. In the US, inventories have remained stubbornly high even over refinery maintenance season. This is a trend that is unlikely to change anytime soon, as refiners increase throughput to ensure enough middle distillates for IMO 2020.

Metals

Zinc TCs strengthen: Zinc treatment charges in China continue to strengthen, partly helped by improving zinc concentrate supply around the globe, whilst inventories at Chinese ports have also edged higher. With global concentrate supply expected to continue growing into 2019, this should continue to be supportive for treatment charges. Stronger treatment charges are likely to see a pick-up in Chinese operating rates moving forward, increasing refined zinc supply.

Agriculture

CS Brazil sugar output: Industry body, UNICA, released 2H October production figures for the CS Brazil region yesterday. The industry crushed 24.86mt of cane over the second half of October, which was down almost 18% year-on-year. Meanwhile sugar production totalled just 958kt over the period, down over 49% YoY. This strong decline was due to the fact that mills continue to allocate a larger proportion of cane towards ethanol production, with domestic ethanol prices at a premium to sugar prices.

Ivory Coast cocoa arrivals: According to Bloomberg numbers, arrivals of cocoa at Ivorian ports have totalled almost 420kt so far in the season starting 1 October. This compares to around 286kt for the same period last year. Moving into the 2018/19 season there were growing expectations of a global deficit, however these arrival numbers suggest that supply from the largest supplier is, in fact, better than expected.

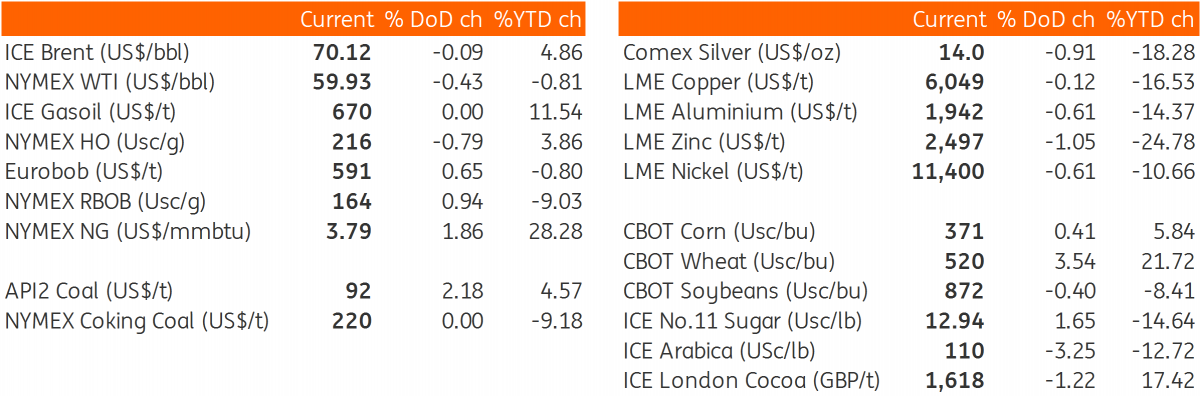

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

CommoditiesDownload

Download snap