Thailand’s GDP growth hits 5-year high of 4.8% in 1Q18

But the strong headline masks an underlying weakness in domestic spending, which is why we don’t expect Thailand’s central bank (BoT) to join the global monetary policy normalization trend anytime soon

Some positives for the THB, but not many

The USD/THB has been creeping up to our recently revised 32.3 forecast for end-2018 (spot 32.2), which we are reviewing for another upward revision. Some positive GDP data may help to stem some of the recent depreciation pressure on the currency, though the narrowing external surplus suggests that the best of the appreciation is over.

| 4.8% |

GDP growth in 1Q18Fastest pace in five years |

| Better than expected | |

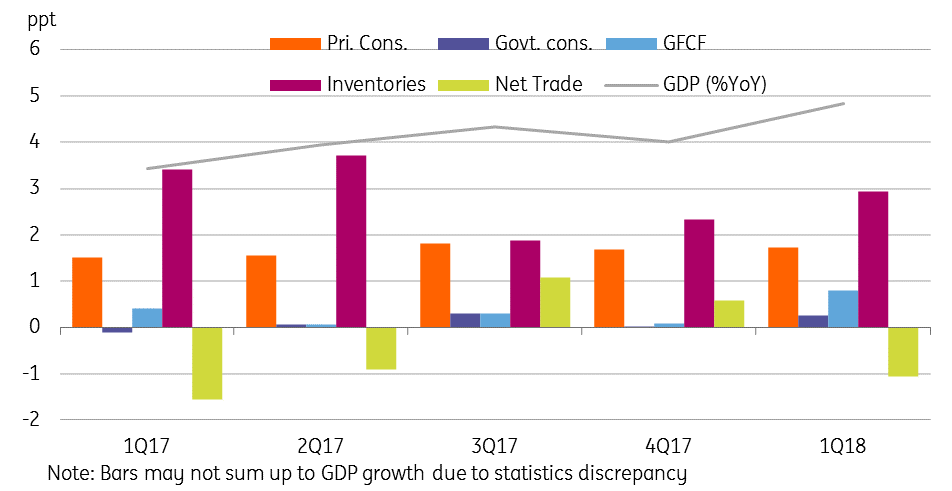

Inventories remain a dominant GDP driver

Thailand’s GDP growth accelerated to a five-year high of 4.8% year-on-year in the first quarter of 2018 from 4.0% in the previous quarter, beating the consensus of 4.0% and our 3.6% forecast. The 2.0% quarter-on-quarter (seasonally adjusted) growth was also the highest in five years and up from 0.5% in 4Q17.

As has been the trend for over a year now, inventories remained the main driver, contributing more than half of GDP growth (see figure). This isn’t a healthy source of growth as the potential de-stocking will weigh down GDP, in our view. The contribution of private consumption to GDP growth was unchanged at 1.7 percentage point (ppt). There was some recovery in government consumption and also in fixed capital formation, though nothing outstanding. And consistent with the narrowing trade surplus, net exports turned out to be a drag on GDP growth, after contributing positively in the previous two quarters.

Agriculture, manufacturing, and hotel and restaurant services were the industry-side drivers of GDP growth in the last quarter.

The expenditure-side sources of GDP growth

Upward revision to 2018 ING growth forecast

The government forecast for GDP growth this year is 4.2%, slightly above the Bank of Thailand’s 4.1% forecast. We consider these subject to more downside than upside risk due to still anemic domestic spending and rising global oil prices causing a greater drag from next exports. That said, the above-expected first-quarter growth prompts us to revise our full-year 2018 growth forecast to 4.0% from 3.5%.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

21 May 2018

Good MornING Asia - 22 May 2018 This bundle contains 2 Articles