Thailand: Manufacturing supports 4Q growth pick-up

Our view that GDP growth improved slightly to 3.5% in 4Q18 from 3.3% in the previous quarter is on track. Still, it’s an unexceptional performance, not justifying the central bank rate hike in December

| 0.8% |

Manufacturing growth in DecemberYear-on-year |

| Better than expected | |

Better than expected December production

Thailand’s manufacturing production growth slowed further to 0.8% year-on-year in December from 0.9% in November, which was revised lower from the 1.0% initial estimate. But the result was better than the consensus expectation for 0.6% growth and far better than our forecast of a 1% fall which rested on steeper export contraction in the last month.

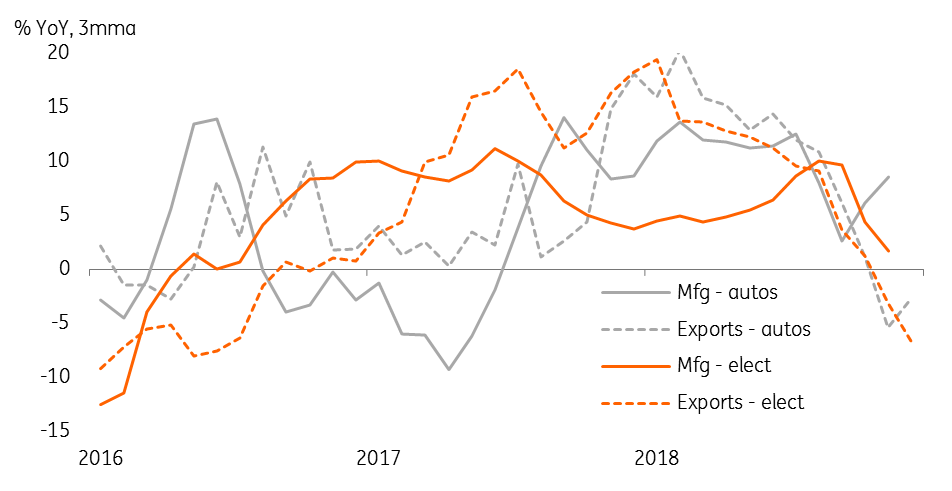

Autos and electronics goods reportedly helped headline growth to remain in positive territory, though it looks transitory as these are the front-line sectors getting hit by the US-China trade tensions, as reflected by their steadily falling exports.

Steady slowdown in autos and electronics sectors

Base effects underlies 4Q18 GDP improvement

While exports remained on a weakening path in the final quarter of 2018, low-base effects aided an improvement in manufacturing growth to 2.4% YoY in 4Q18 from 0.9% in the previous quarter. This is consistent with our estimate of a slight pick-up in GDP growth to 3.5% from 3.3% over the same quarters (data due on 18 February). It’s still not an exceptional starting point for the government looking for a 4% GDP growth in 2019.

We are wondering why the Bank of Thailand even bothered to tighten policy in December. We aren’t expecting any move this year, while the authorities have started to signal an unchanged central bank policy. Meanwhile, mounting political uncertainty will weigh on local markets, including the THB who’s year-to-date outperformance among Asian currencies, with 3.2% appreciation against the USD, remains at risk of being reversed.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

29 January 2019

Good MornING Asia - 30 January 2019 This bundle contains 3 Articles