Thailand manufacturing is recovering slowly

The fifth straight monthly rise in production in September underscores recovery. But growing political uncertainty clouds prospects

| -2.8% |

September manufacturing growthyear-on-year |

| Better than expected | |

A slow grind upward

Thailand’s manufacturing activity continued to improve in September. A 3.3% month-on-month rise in output after the 5.1% MoM rise in August - making it the fifth consecutive monthly increase reflecting a gradual recovery.

So far the sector has clawed back 90% of the plunge it suffered in April at the height of the Covid-19 outbreak. But the index is still 2.8% below its level seen a year ago, though it’s a marked improvement over -9.1% YoY in August and a small annual decline since the onset of the negative trend in early 2019.

The good news is that things are improving, but the bad news is that the path is going to be rough given growing downside risk to the economy from ongoing political turmoil.

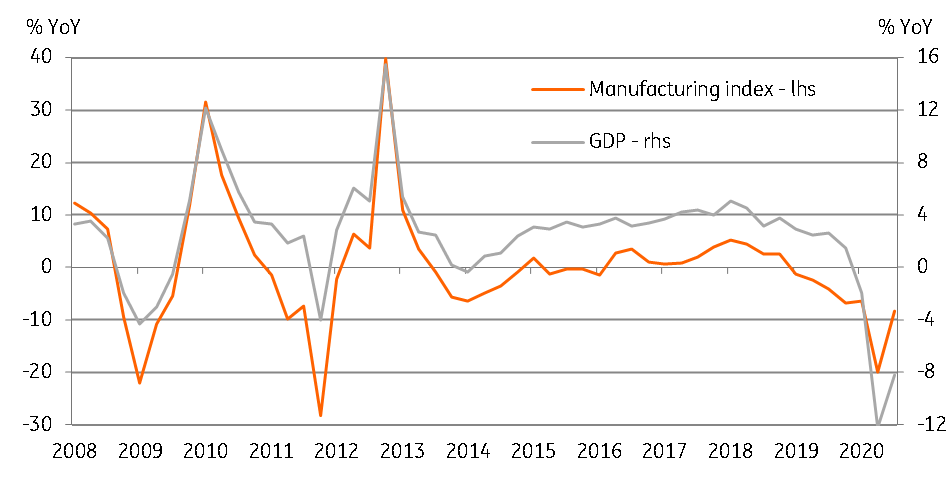

Where manufacturing goes GDP follows

Politics dampens recovery

3Q20 manufacturing growth of -8.3% YoY was a sharp improvement from -20.0% in 2Q, which supports our forecast of a smaller 3Q GDP decline, -8.2% YoY instead of -12.2% in the previous quarter. The persistently weak service sector and seasonal agriculture weakness, however, impart downside risk to our 3Q GDP view (data due in mid-November).

Without the return of tourists and a vigorous export recovery, there is no imminent end to the negative growth trend. Adding to the weak trend is an escalation of political tensions recently, which not only undermines economic confidence but also holds back implementation of macro policy stimulus.

Surprisingly, the Thai baht isn’t doing as bad as one would have expected it to in this environment. The currency has been steady around 31.20 against the USD for most of the month and, with 1.8% month-to-date appreciation, it’s the second-best performing Asian currency in October.

That said, we aren’t confident of the currency's lasting resiliency to the political jitters. We maintain our forecast of weakness to 32.30 by year-end.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

ThailandDownload

Download snap

28 October 2020

Good MornING Asia - 29 October 2020 This bundle contains 3 Articles