Covid hasn’t hurt Taiwan’s trade but climate change will

Taiwan's export and import data were very good for May and that's creating a puzzle as to the impact of Covid-19 on the economy. We keep our GDP growth forecast for the second quarter of this year but are downgrading it for the full year, 2021. The effects of climate change are one of the reasons

Big trade growth and trade balance

Covid-19 virtually disappeared from Taiwan but there's been a rise in cases since the middle of May this year. Despite that, it hasn't affected trade performance at all. Exports grew 40.9% Year-on-Year in May and at the highest single month value on record. Imports grew 51.1%YoY. The trade balance was high at $6.16 bn.

Looking at specific sectors, we're seeing more trade activities in minerals, rubber and plastic. And there was a steady growth of electronic goods of near 30% YoY.

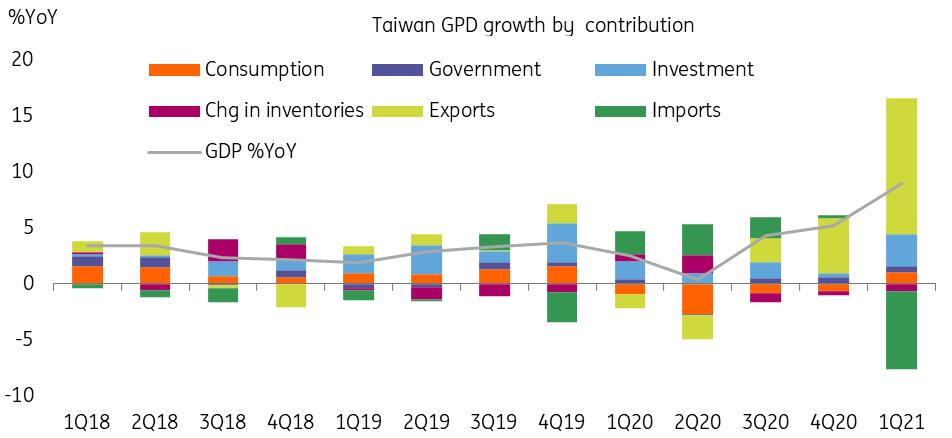

The high trade balance will add to GDP growth in the second quarter of this year; it's expected to come in at 6.1%YoY in 2Q after an upward revision of GDP growth of 8.92%YoY in the first quarter by Taiwan's government.

But we are still downgrading Taiwan's 2021 GDP forecast

Even with such an unexpectedly good performance on trade in May, we are still downgrading Taiwan's GDP for 2021 from 4.9% to 4.1%.

There are two major reasons:

Covid-19: It doesn't seem that Taiwan's government will implement a lockdown, with cases still around 300 per day. There aren't enough vaccines for the entire population which, given the experience of other economies, could delay virus' suppression. Several of the infected groups are factory workers and that could affect both industrial production and exports.

Rainfall: Despite the fact that there's been more rain in the past two weeks, it still looks as though the summer will be exceptionally dry and this is a critical issue for semiconductor factories. Combined with a number of electricity blackouts, one option for electronic goods' producers to avoid raising prices is to reduce the number of chips in any product given the global shortage. We think that's quite likely.

If these two problems persist, we believe industrial production will slow in the second half of the year.

This could be mitigated by fiscal stimulus from the Taiwan government. But so far, the stimulus announced is around 1.75% of the forecast 2021 GDP, which is small compared to the 12% of GDP we saw in 2020.

Taiwan GDP recovery

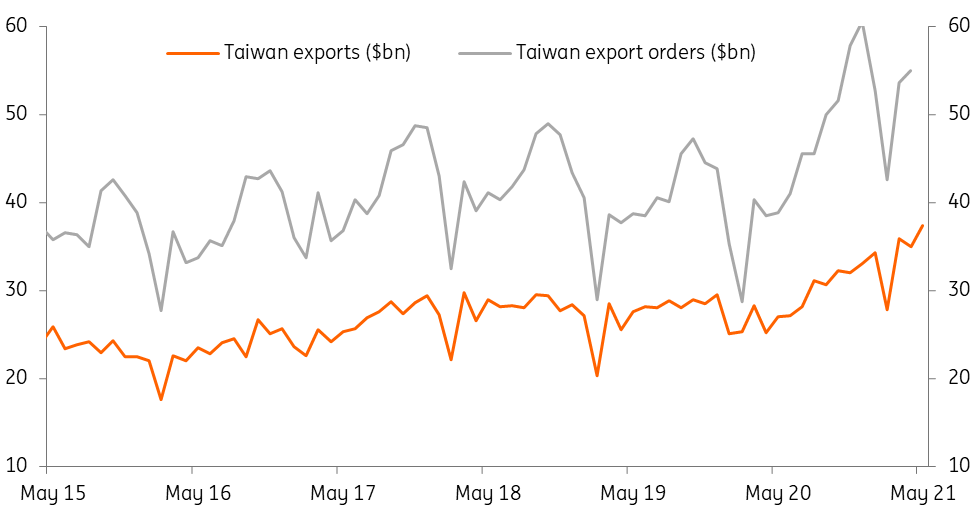

Taiwan's export orders v exports

The gap between export orders and exports widens reflecting faster export growth from overseas factories owned by Taiwan companies compared to exports from Taiwan

Climate change could be part of the business equation

And, let's be frank. If drought and blackouts are climate issue, they're unlikely to disappear. This is also a headache for business plans because of the uncertain nature of climate change. Do factories need to move out of Taiwan to avoid drought and blackouts if the climate issue persists? We think that this is already in the mind of producers as the gap of export orders and exports is widening. That tells us that the growth of exports from overseas factories owned by Taiwan companies outpaced exports from factories in the country itself.

Climate change could be part of a business decision.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

8 June 2021

Good MornING Asia - 9 June 2021 This bundle contains 2 Articles