Taiwan: weak PMI not in line with strong GDP

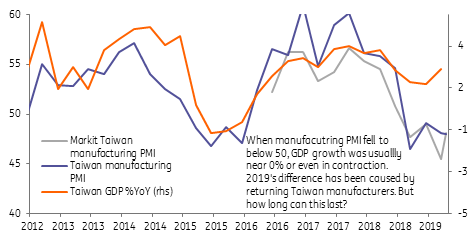

Taiwan's manufacturing PMI tells a story of shrinking activity due to weaker demand for electronic products. But GDP growth in 2Q19 shines. This is a usual phenomenon for Taiwan, so how long will it last?

Manufacturing PMI stays below 50

Taiwan's official PMI fell to 48.0 in July from 48.1 a month ago though Markit manufacturing PMI edged up to 48.1 from 45.5. In any case, both figures show manufacturing activities shrinking in July. And that's highlighting weak export demand. The new export orders PMI sub index came in at 46.8, falling from 48.1. Domestic demand for manufacturing parts and products also shrank in July. New orders fell to 48.2 from 48.7.

All in all, Taiwan's manufacturing sector continues to contract.

How can GDP shine when manufacturing activities contract?

Why GDP could have jumped

GDP growth jumped to 2.41%YoY in 2Q19 from 1.71%YoY in 1Q19.

Manufacturing makes up 28.95% of Taiwan's GDP. So, just why is there this contrast between manufacturing and far better GDP figures? The government explained that the gap was filled by investments of manufacturers returning to Taiwan from mainland China. Capital goods imports increased by 21.8%YoY in 2Q. The government estimated the capital formation makes up 1.23% of the 2.41% GDP growth.

It seems that investments by the Taiwan manufacturing "returners" has also supported consumption. Consumption grew 1.57%YoY in 2Q. According to the press report, there were 100 Taiwan enterprises returning to Taiwan, investing TWD500 billion in total.

Is this too good to be true?

We are not particularly optimistic about Taiwan's economic situation.

- The investment spree of Taiwan's "returning" manufacturers is a one-off event. There will not be an unlimited flow of Taiwan manufacturers moving back to Taiwan from the mainland

- There are reports that Taiwan is not prepared for the Taiwan returners'. The famous five insufficient factors are the problems faced by those "returning" manfuacturers, notably a lack of water, electricity, land, workers and talent. It takes years to build water and electricity capacity. Even when the government can provide land, these lands should have the basic infrastructure around them, for example, highways linking to ports and airports. Moreover, Taiwan's unemployment rate is not high (latest at 3.74%), a sudden increase in demand for workers will push up wages and can become an inflation issue.

The 2Q number pushes up our GDP forecast

Even that we think the "returning" manufacturers only provide a one-off boost to Taiwan, we have to revise our GDP forecast as the GDP in 2Q19 at 2.41%YoY was much higher than our forecast of 1.4%YoY, we revise the full-year GDP forecast to 2.08%.

We keep the forecasts on 3Q and 4Q unchanged at 2.0%YoY and 2.2%YoY, respectively, as we believe the investment spree is one-off and the PMI reflects the fact that demand for electronic products is still weak.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

1 August 2019

Good MornING Asia - 2 August 2019 This bundle contains 4 Articles