Swiss GDP growth not as good as it seems

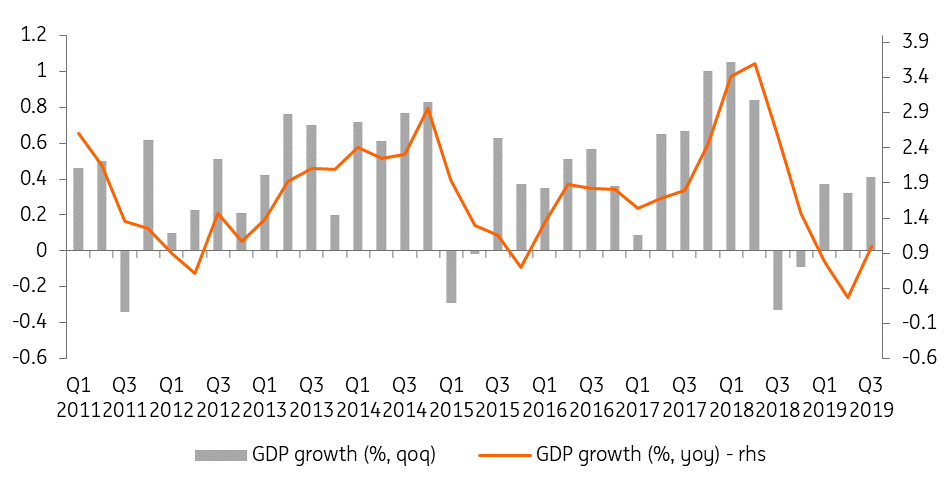

Swiss GDP increased by 0.4% quarter-on-quarter in 3Q19, compared to 0.3% in 2Q19. But the good figure masks less favourable details

Strong growth figures but less favourable details

Switzerland's GDP grew by 0.4% in the third quarter of 2019, compared to 0.3% in the previous quarter. This growth was supported primarily by the export of chemicals and pharmaceuticals as well as energy. According to SECO (State secretariat for economic affairs), without the boost from these two sectors, GDP growth would have been close to zero. Overall, the cyclical slowdown was confirmed. Private consumption growth slowed to 0.2%, from 0.3% in the previous quarter. Investments in capital goods and construction recovered slightly, but not enough to be a real boost to economic growth, as they only offset the sharp decline observed in 2Q.

GDD growth

Signs of stabilisation?

For the future, the Swiss economy is still facing some headwinds, although some signs of stabilisation are beginning to emerge. Leading indicators are still shaky, but stopped falling in October. Thus, the composite PMI indicator stood at 49 in October, up sharply from 43.4 in September. The KOF leading indicator also rose slightly to 94.6 in October from 93.1 in September, although it remains well below its long-term average. The question now is whether the rise in these indicators is temporary or whether it heralds an acceleration of the Swiss economy. We tend to believe the second option could prevail, if there is no shock. As a result, GDP growth is expected to reach 0.9% in 2019, much lower than the growth observed in 2018 (2.8%), which was boosted superficially by major sporting events (television broadcasting rights being collected by companies based in Switzerland). For 2020, we expect GDP growth of 1.2%.

Economic risks are on the downside. An intensification of trade tensions between the US and China, or a trade battle between the EU and the US, could have a significant impact on the Swiss economy. The same applies to Brexit without an agreement, or a very sharp deterioration in relations between the EU and Switzerland. Turbulence on the financial markets could also push the Swiss franc to appreciate and lead to a decline in Swiss exports.

Leading indicators stopped falling

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap