Surprise UK services inflation dip bolsters case for rate hike pause

Services inflation is the bit of the CPI basket that the Bank of England cares most about right now, and January data saw a surprise dip. While it may not be enough to talk the committee out of a 25bp hike in March, if this trend continues, it probably points to a pause from May

The latest UK inflation numbers certainly throw in a curveball for the Bank of England’s March meeting.

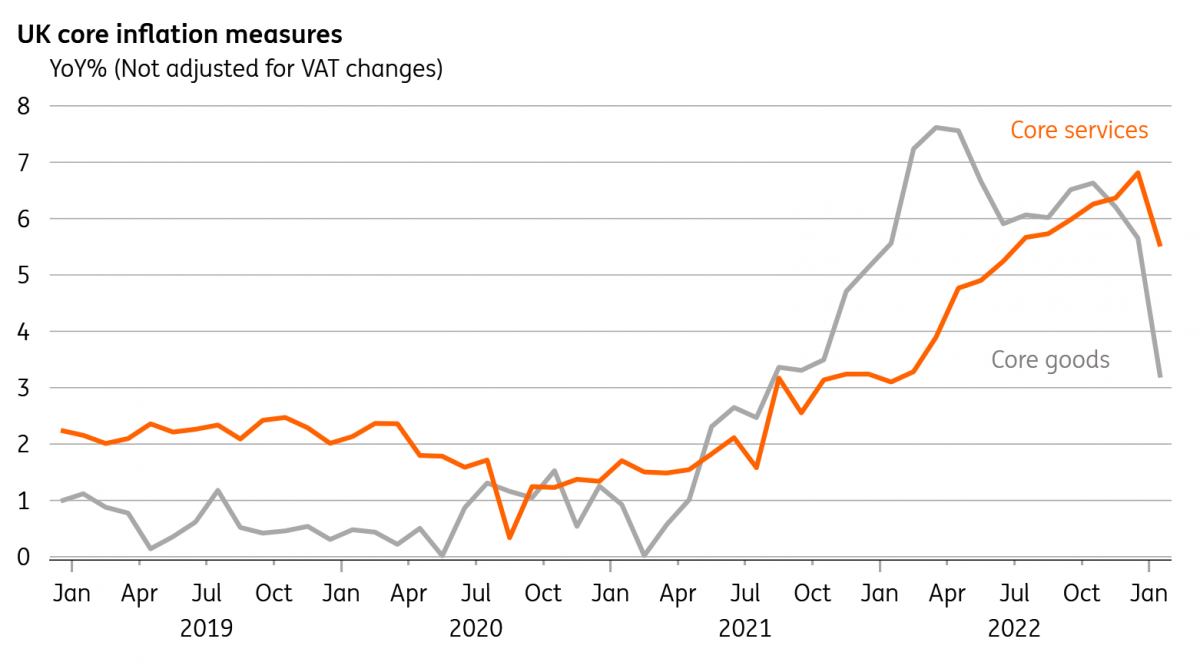

Headline CPI ticked lower to 10.1%, which was partly down to a near-4% fall in petrol/diesel prices across January. But core inflation was also much lower than expected, and slipped below 6% for the first time since last June. Some of this is linked to ongoing disinflation in goods categories, and unsurprising consequences of improving supply chains and lower consumer demand.

But the Bank of England has said it is most interested now in “inflation persistence”, which is code for identifying trends in the inflation data that might still be relevant over a two-year horizon. Our recent analysis showed that it’s the services indices that are typically less volatile and show more persistent trends. And contrary to Bank of England forecasts for core services inflation to continue notching higher, we saw a surprise dip, partly as a result of a month-on-month fall in various hospitality categories. Updated weights have probably also played a role, albeit a pretty minor one.

Core services inflation in a surprise dip

A word of caution: one month does not make a trend. By definition, the Bank of England’s focus on “persistence” suggests policymakers are going to be less fazed by month-to-month gyrations in this data. That said, our view is that services inflation has probably peaked. While wage growth has shown only very limited signs of slowing in recent surveys/official data, lower gas prices are a potential boon for the service sector. Successive ONS Business Insight surveys have indicated that higher energy prices have been a more commonly cited reason for raising prices in the service sector than labour costs.

Will today’s data be enough to cast serious doubt over a potential March rate hike? The Bank dropped a firm hint in February that its latest 50bp rate hike might have been the last, though recent comments have suggested that committee members are still minded to hike a little further. We are therefore still pencilling in a 25bp hike next month for the time being - and the Bank's own Decision Maker Survey in early March is the next big data point to watch.

But if this trend in services inflation persists, then it would be a strong argument in favour of pausing in May.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap