Super-strong Australian employment growth

The Reserve Bank of Australia (RBA) will have its work cut out to keep sounding dovish if it is faced with more data like this latest February employment release. Their defence will be “There is still a long way to go”. Maybe. But at this sort of pace, it won't take until 2024 to get there

| 88,700 |

Employment changeFebruary |

| Higher than expected | |

The numbers

The bare facts of this latest labour release don't take much explaining. After a very solid 29.5K increase in employment in January, Australia added a further 88,700 jobs in February. Not only that, but these were entirely in the full-time sector, which means that the spending power implications of this are much stronger than had this been split between part-time and full-time jobs.

The unemployment rate for January was revised lower to 6.3%, but the February release showed it falling still further to only 5.8%. This came about from a 28,200 fall in the numbers of unemployed. There were minimal changes in the labour force (participation rate remains 66.1%) so we can't attribute anything meaningful to the drop in the unemployment rate to quirks in the denominator of that calculation.

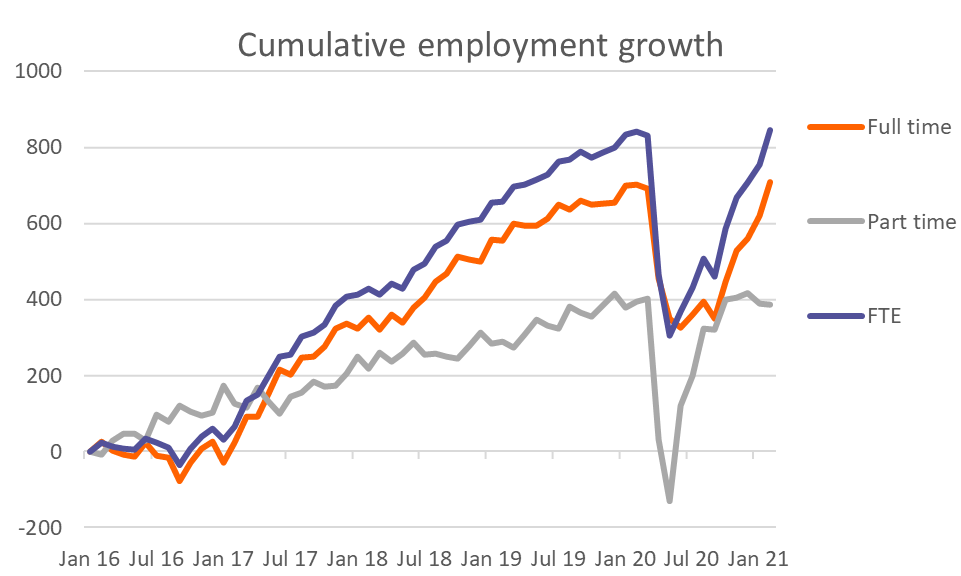

Looking at the employment side of the release, full-time jobs look to have regained all the ground lost as a result of the Covid-19 pandemic. Everything from here on in will eat away at any slack the RBA believes still exists in the labour market. And the faster that happens, the sooner we can expect them to have to concede that their policy stance is no longer appropriate.

Australian employment back to pre-covid-19 levels

What does this mean for the Reserve Bank of Australia

From March 10, when RBA Governor Lowe stepped up to the podium to deliver a speech designed to bring Australian government bonds back under control and moderate AUD strength and followed by the dovish minutes released on 15 March about the March rate meeting, the RBA's message has been clear. They consistently state that there is still a very long way to go before they will change their policy stance. And any eventual change rests firmly on actual progress being made in the labour market, without which, they feel, no sustained increase in inflation is likely.

But while all that is fair, they have been pushing back at a market that has at times challenged their statement that such progress is not likely until 2024. Today's employment release provides the market with another excuse to challenge the RBA's assertions, and reasonably so. And just as the FOMC may have managed to avoid a bigger selloff in US Treasuries overnight, but will still likely see bond yields drift higher over the coming weeks, the same looks likely for longer-maturity Australian government bonds, and for that, we don't need the RBA to do anything with rates.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

18 March 2021

Good MornING Asia - 18 March 2021 This bundle contains 3 Articles