Spanish core inflation accelerates to record high of 7% in December

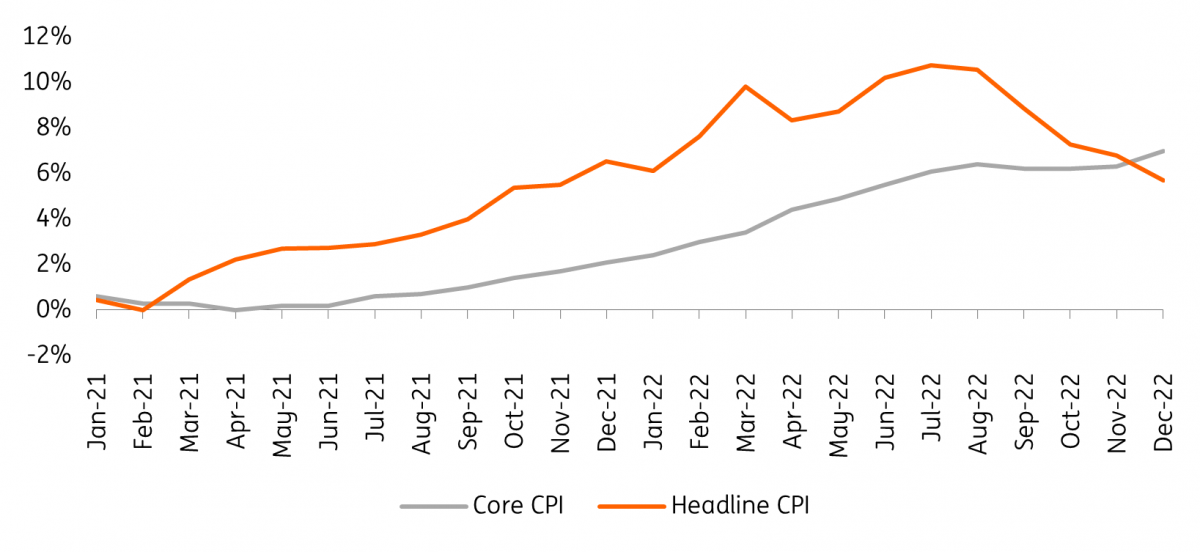

The final inflation figures show that Spanish core inflation strongly accelerated to 7% in December, from 6.3% in November. Although lower energy prices have brought some temporary relief to headline inflation, this shows that inflationary pressures are still very high

Spanish core inflation above headline inflation for the first time

The final inflation figures and details by component revealed by Spain's statistics office INE this morning show that core inflation rose more sharply than expected in December. The core CPI reached 7% in December, a new record, and a strong acceleration from the 6.3% in November. As a result, core inflation is now above headline inflation for the first time. This shows that the underlying price pressures in the economy are still at record levels. The current drop in headline inflation to 5.7% is thus solely due to the recent sharp fall in energy prices, such as electricity and fuels. Thanks to warm winter weather, gas stocks in Europe are above the five-year average, easing some pressure on energy markets. These favourable base effects in the energy component bring some relief to headline inflation.

Spanish core inflation above headline inflation for the first time

Underlying inflationary pressures will remain high

Although the coming headline inflation will fall further thanks to these favourable base effects for energy, inflationary pressures in the rest of the economy will remain high. Besides core inflation, the food component will also continue to contribute positively to inflation figures. The details show that food prices continued to rise further to 15.7% year-on-year in December, from 15.3% the month before. This puts food inflation at its highest level since measurements began in January 1994. Food inflation will also remain high in 2023. Moreover, fertiliser exports were severely disrupted last year, which might also affect global food production in 2023.

In other eurozone countries, favourable base effects in the energy component will cause further declines in headline inflation in the coming months. However, the ECB will not determine its policy based on the more volatile energy prices but will mainly look at whether core inflation is cooling sustainably. It will therefore be careful to announce a policy reversal before core inflation also starts to fall. Moreover, we should not forget that energy prices will rise again later in 2023, especially if a reopening of the Chinese economy drives up demand for liquefied natural gas.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap