Spain’s economic growth picks up while core inflation falls again

The Spanish economy expanded 0.5% quarter-on-quarter in the first three months of the year, mainly due to strong growth in investment and net exports. Inflation rose again to 4.1% in April, but this was mainly due to unfavourable base effects. Core inflation fell again

GDP picks up in 1Q

Spanish GDP was up 0.5% QoQ in the first quarter of 2023, above the market consensus and also above our own forecast of 0.3%. A decline in consumption was offset by an increase in investment and net exports. As for GDP growth in the second quarter, we expect a sustained recovery thanks to a strong services sector and recovery - albeit much more gradual - in the manufacturing sector. Spanish companies saw strong inflows of new orders that will support growth next quarter. In particular, a further upturn in the tourism sector will contribute significantly to growth rates this year. In 2022, the number of international visitors was still 14% below the pre-Covid year 2019. Closing this gap will boost Spanish growth. Right now, the difficult economic backdrop seems to be having little impact on the travel intentions of foreign visitors. According to the latest February data, the number of international visitors was almost at the same level as in 2019. For the second half of this year, however, we expect headwinds from higher financing costs to weigh more heavily and slow economic activity. For all of 2023, we assume average growth of 1.5%.

Headline inflation rises, while core inflation comes down in April

Spanish inflation rose to 4.1% in April after falling sharply to 3.3% in March. Meanwhile, core inflation decreased to 6.6% in April from 7.5% in March. On a monthly basis, prices rose 0.6% in April, higher than the 0.4% increase seen in March. The rise in headline inflation was expected and can be attributed to unfavourable base effects, as energy inflation declined in April 2022 after rising in March due to the outbreak of war in Ukraine. Core inflation, therefore, provides a better picture of the evolution of inflationary pressures in the country. The decline in core inflation shows that price pressures are quietly easing, although they are still very high.

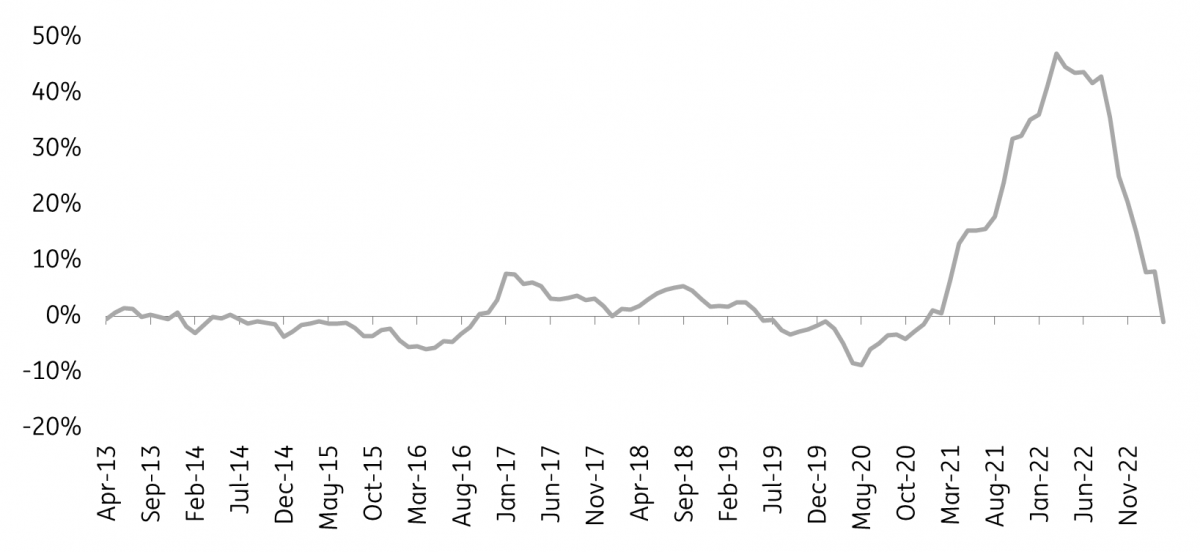

There is a growing divide between the service and manufacturing sectors. While the number of manufacturing companies seeking to raise prices has fallen significantly, Spanish service companies currently have no plans to slow their price increases. This is due to several factors, including stronger nominal wage increases. In addition, many service companies are struggling to meet growing demand, making it easier for them to pass on higher prices. In contrast, in manufacturing, cost pressures have decreased significantly, reducing the need to raise prices further. In fact, producer price inflation was negative at -1% in March. A year ago, it was still more than 40%.

Spanish producer price inflation back to normal levels

According to our projections, inflation will average 3.8% in 2023 and 2.7% in 2024. Energy prices, much lower than last year, will contribute to a further decline in headline inflation for the rest of this year. However, core inflation is expected to remain high.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap