South Korea’s disappointing monthly activity suggests sharp slowdown in 4Q GDP

Manufacturing output, retail sales, and facility investment all declined in October. Sluggish consumption and investment are expected to weigh on growth in the current quarter

| -3.5% |

Industrial production%MoM sa |

| Lower than expected | |

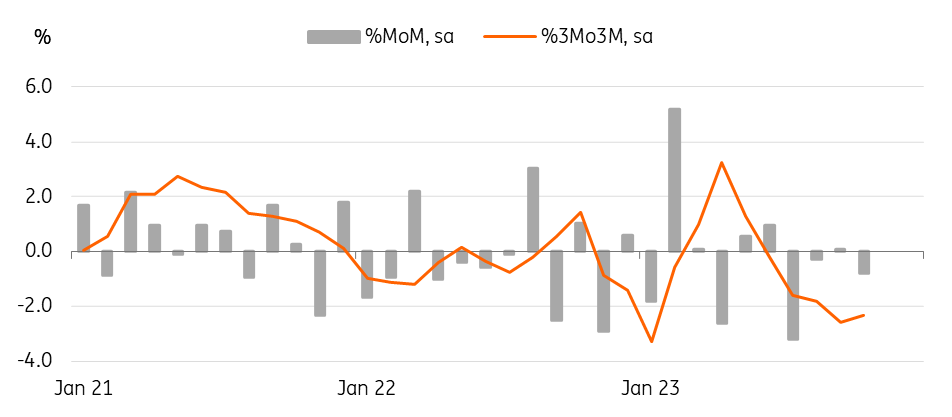

All industry output slid 1.6% MoM sa in October, the first decline in three months

Mining and Manufacturing industrial production unexpectedly dropped by 3.5% month-on-month, seasonally-adjusted (vs 1.7% in September, 0.4% market consensus) in October, mostly led by a plunge in semiconductor output (-11.4%). The sharp decline is probably a technical payback from the double-digit increase in the past two months. (13.5% in August, 12.9% in September). Importantly, semiconductor inventories levelled down quite rapidly, thus we are keeping our view on a semiconductor recovery unchanged for now. Meanwhile, partially offsetting the decline, electronics (10.4%) and vehicles (3.2%) output gained.

Service activity moved down quite sharply -0.9% MoM sa in October for the first time in five months. Leisure and sports continued to gain (4.2%) but other major service sectors, such as whole/retail sales (-3.3%), finance (-1.2%), real estate (-3.0%), and accommodation (-2.3%), declined, reflecting the slowdown in the property market and private consumption.

Semiconductor output stays on recovery path despite plunge in October

Retail sales dropped -0.8% MoM sa in October, falling three times in the past four months

The drop in non-durable goods (-3.1%) was the main reason for the overall decline. Durable goods sales rebounded 1.0% MoM sa for the first time in four months, boosted by strong mobile phone sales (12.1%) related to new model launches. However, vehicle sales dropped -1.75%, falling back after a temporary rebound in September. The government has extended its tax benefit programme for electric vehicle purchases until year-end to boost car sales, but we think high car financing costs will likely be a hurdle for a meaningful recovery.

Consumption will likely weaken further in 4Q23

Investment activity was a bit mixed in October

For facility investment, machinery (-4.1%) and transportation equipment (-1.2%) fell in October as chip-making equipment imports declined, but machinery orders rebounded with quite strong demand from the private sector. We think IT investment will likely recover meaningfully early next year, but the investment in 4Q23 should be suppressed.

On the other hand, construction completion rose by 0.7% MoM sa in October, marking the fourth consecutive month of increases. Despite the ongoing struggle in the property market and project financing, construction activity has slowed only marginally. We found that compared to the previous quarter, residential construction weakened as expected, but civil engineering held up pretty well. Forward-looking construction order data has mostly declined throughout the year, thus we continue to believe that construction will be the main drag on growth for a considerable time.

Construction will be a major drag on growth

GDP outlook

Despite disappointing manufacturing IP results today, we continue to believe in a recovery in manufacturing, backed by solid semiconductors and vehicle output. More worrisome is consumption and investment. We believe tight financial conditions are starting to bite private consumption more meaningfully. For investment, IT equipment investment will likely rebound next year along with a recovery in global semiconductor demand and as the inventory adjustment ends, but construction investment will remain the main drag for a considerable time. Putting the latest soft and hard data together, we expect the current quarter GDP to decelerate considerably (0.1% quarter-on-quarter sa vs 0.6% in 3Q23).

The Bank of Korea will likely keep restrictive policy settings as long as possible, given the recent pick up in household debt and sticky inflation. But the slowdown of the economy will likely shift the BoK’s policy stance towards easing in the first half of next year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap