South Korea: Consumer inflation slowed in March, mainly due to falling fuel prices

Consumer prices slowed sharply in March and the Bank of Korea is expected to keep its policy rate at 3.5% next week

| 4.2% |

Consumer inflation%YoY |

| Lower than expected | |

Consumer inflation slowed in March, mainly due to falling oil prices

Headline CPI slowed to 4.2% YoY in March (vs 4.8% in February and 4.3% market consensus), mainly due to falling fuel prices and base effects. Prices of gasoline (-17.5%) and diesel (-15%) dropped the most, while food prices continue to rise, by 6.1%. Heating costs increased due to the severe cold in January and Feburary.

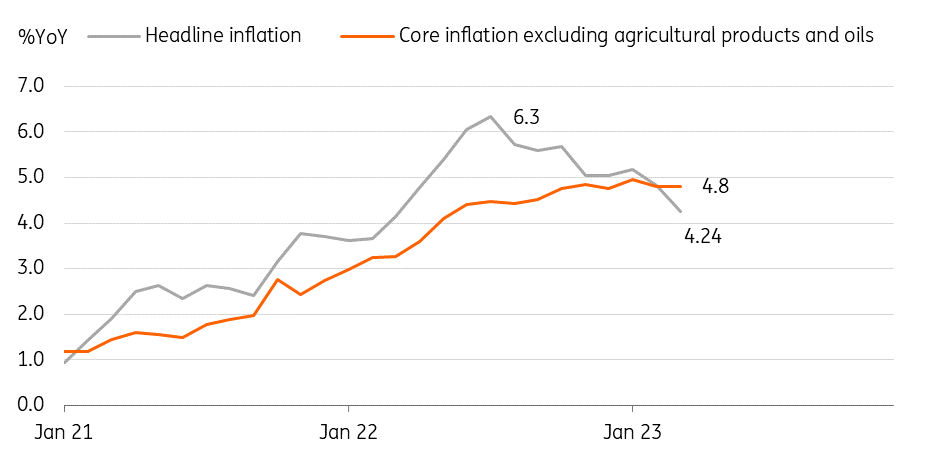

Headline CPI decelerated sharply. Core CPI remains sticky

Excluding volatile oil and agricultural prices, core inflation was anchored at 4.8%. Core CPI tends to be more sticky than headline - it will take more time to see clear signs of any slowdown. Among service items, rental prices (0.9%) and eating out (7.4%) continued to decelerate in March. As we have already noted, the housing market slump which began last year began to be reflected in the price index. The monthly decline in rent prices deepened in March. Prices for eating out and other personal services remained high, reflecting ongoing second round effects of price hikes for utilities and food.

Rents declined for the second month, but the cost of eating out remained high

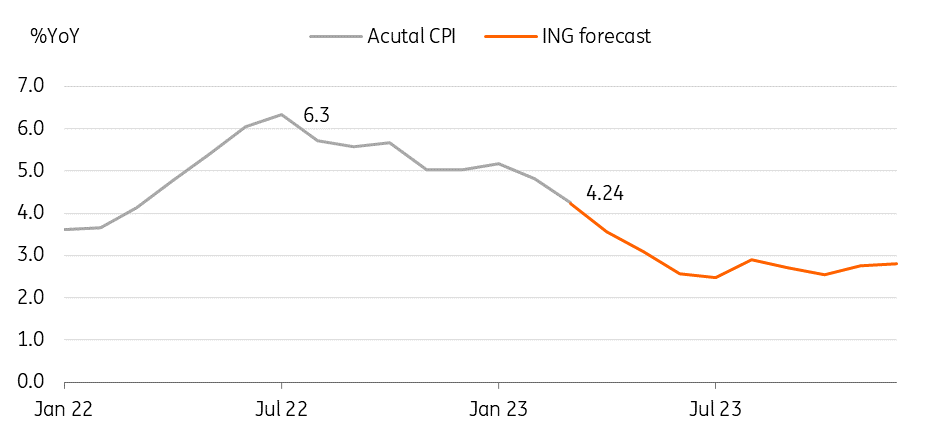

Inflation is expected to cool, despite the recent sudden rise of global oil prices

Although the sudden price hikes in global oil prices will add to inflationary pressures, we still believe that the downtrend in inflation will continue throughout the year.

Base effects will play a main role in any slowdown in the second and thrid quarters, unless global oil prices return to last year's above $100 level. Second, we have just began to see a decline of rents but this is set to have a more prominent impact on service prices in the near future. Third, the government has postponed electricity and gas price increases for the time being, fearing additional charges would push up inflation again. Fourth, if necessary a government fuel tax cut could partially mitigate the price shock. Last but not least, higher commodity prices could lead to a more serious economic downturn in Korea, so offering downside pressure on inflation.

Inflation is expected to slow throughout the year

Bank of Korea watch

The BoK is scheduled to hold a policy meeting next Tuesday and expects to keep its policy rate at 3.5%, given clear signs of slowing inflation. The BoK will maintain its hawkish stance for the time being - as a precaution against a sharp rise in global oil prices that could add to upward inflationary pressures.

As previously mentioned, inflation is expected to head towards 2% over the next few months. We think that the BoK will stay unchanged until the third quarter of this year. In addition, even if inflation rebounds due to rising global oil prices, it will be difficult for the BoK to resume its hiking cycle as further rate hikes could lead to a more serious economic downturn at a time when underlying growth conditions are already weak. Despite high inflation-related uncertainties, we maintain our previous forecast that the BoK will cut interest rates in the fourth quarter.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap