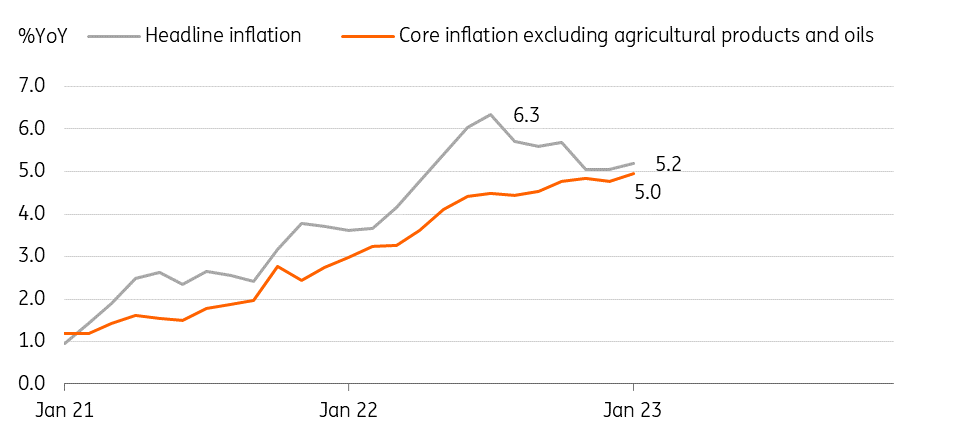

South Korea: Consumer inflation accelerated again in January

Due to a cold snap, utility bills and fresh food prices rose more than expected in January. This could strengthen the Bank of Korea's tightening stance. But we still think that the BoK will stay put at its February meeting and monitor price changes in the coming months

| 5.2% |

Consumer price inflation% YoY |

| Higher than expected | |

Headline inflation rose more than expected in January

Upside surprises came mainly from utility prices (electricity, gas, water), which rose the most (28.3% in January vs 23.2% in December). Basic electricity and gas rates have risen over the past few months, and the continuing cold weather has resulted in additional rate increases as the progressive fee system is applied. Fresh food prices, especially vegetables, also increased quite sharply due to the bad weather. Meanwhile, gasoline prices (-4.3%) continued to drop as oil prices fell significantly, more than offsetting negative tax effects from the fuel tax cut reduction.

January CPI reaccelerated for the first time in six months

Public service-led inflation is a concern

In the coming months, several public service prices are set to rise or are planned. For example, taxi fares in Seoul have already risen in early February, and some other public transportation fares are expected to rise soon. This is also likely to trigger other fare hikes in the Metropolitan Seoul area, like Gyeonggi Province. Public service-led inflation is a major concern for the government and the Bank of Korea because it could push up private service prices as a second-round effect.

The government has urged local governments to refrain from raising public service charges. At the same time, the government plans to expand energy subsidy programmes not only for low-income- households but also for middle-income households. As weather conditions improve and government support is dispensed, price pressures on utilities should gradually diminish.

The higher-than-expected January CPI results will keep the Bank of Korea in a hawkish frame of mind, but at this point, the data is unlikely to trigger a February rate hike. Aside from utility prices, products and service prices grew at a more moderate pace in January. Also, we see that domestic economic activity has slowed pretty sharply in recent months and external conditions have also worsened. Last night, the Federal Reserve slowed its tightening pace with a 25bp hike, thus the BoK will take time to monitor the price trend and examine the impact of earlier rate hikes.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap