Singapore’s manufacturing signals weak 4Q GDP

We maintain our forecast of a slightly moderate GDP contraction in 4Q20, of -5.0% year-on-year compared to -5.8% in 3Q20, though this view is at risk of more downside judging from the weak start to the quarter

| -19% |

October IP fallMoM, SA |

| Worse than expected | |

A downside manufacturing surprise

A -19.0% month-on-month (seasonally adjusted) plunge in Singapore's industrial production in October was much steeper than our -12.4% MoM forecast for the month. However, it isn't a complete surprise in view of two straight months of contraction in the city state’s non-oil domestic exports (-5.3% MoM SA in October followed by -11.4% in September). This pushed the year-on-year IP growth into negative territory; at -0.9% YoY it was a sharp swing from the 25.6% surge reported for September.

Weakness was felt across the board in all the main manufacturing sectors. However, pharmaceuticals and electronics were the biggest laggards. Just as these were the main sources of manufacturing strength earlier in the year, they were at the root of the weakness in the latest month. A 67% MoM plunge in pharma nearly reversed the 70% surge in September, pulling the year-on-year output growth of this sector sharply down to 15% in October from 114% in the previous month. And the close to 10% MoM fall in electronics pushed the YoY reading to -0.6% from +33.1%.

Separating trend from noise

Prepare for steeper 4Q GDP fall

Weak electronics output and exports in October may hint at tapering in the global electronics upcycle, while the typical holiday season rise in demand for new electronics items will largely be absent this year. The pharmaceutical sector has been a disproportionate beneficiary of the pandemic, though excessively volatile activity here recently has caused sharp swings in overall manufacturing growth.

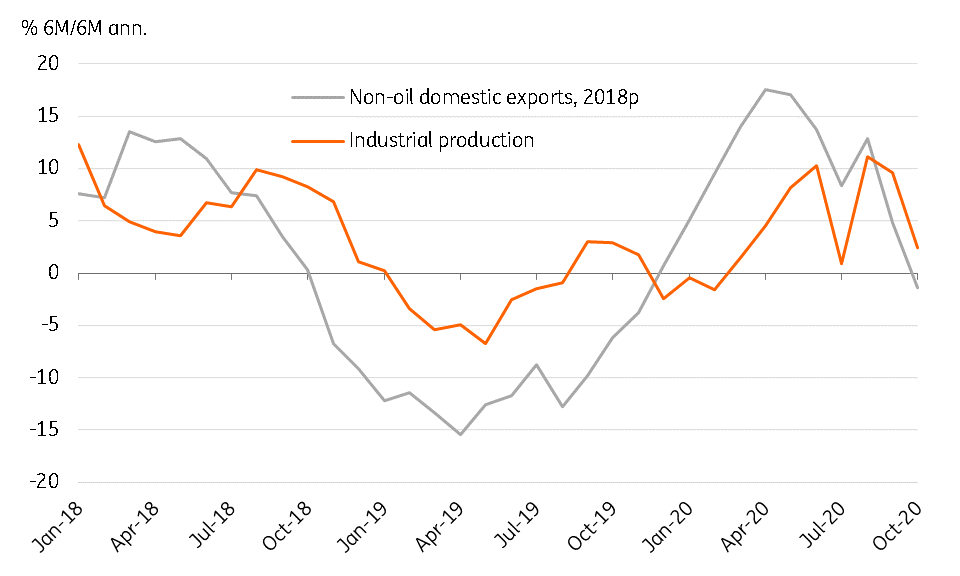

Therefore, besides the year-on-year or the month-on-month growth rates, it pays to observe six-monthly annualised growth for a clear underlying trend. And this has been pointing downwards since August for both NODX and IP, as the graph above shows.

Indeed, weak October activity growth heralds weak GDP growth in 4Q20. While we anticipate a slightly moderate GDP contraction in 4Q20, of -5.0%YoY compared to -5.8% in 3Q20, this view remains at risk of more downside than upside risk.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap