Monetary Authority of Singapore retains all policy settings but GDP disappoints

The MAS maintained all policy settings today, keeping a watchful eye on the path of core inflation. Meanwhile, first quarter GDP came in below expectations

MAS stands pat as expected

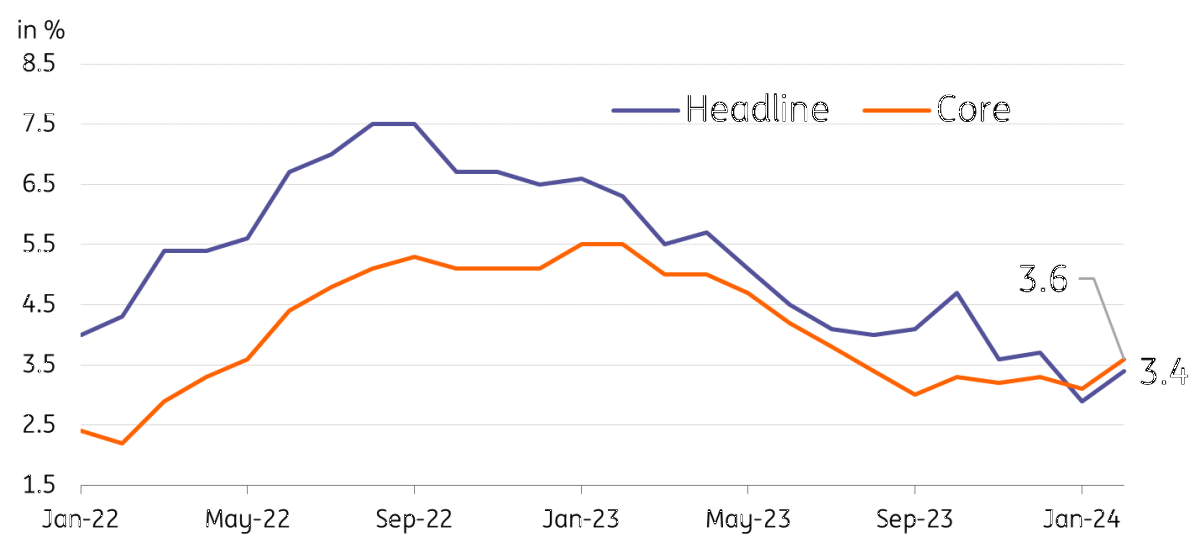

The Monetary Authority of Singapore (MAS) maintained all policy settings, keeping the slope, level and width of the policy band. This move was widely anticipated by the market. All previous forecasts were largely maintained with growth still tipped to settle between 1-3% while forecasting both core and headline inflation to settle between 2.5-3.5% year-on-year.

Just like in the previous meeting, the decision to hold all settings untouched was linked to concerns about lingering price pressures with the MAS indicating it needed to maintain the current stance to "keep the restraining effect on inflation". Inflation is expected to stay elevated in the near term due to the implementation of the last round of the goods and services tax (GST), adjustments to utilities and the recent uptick in global energy prices.

With inflation projected to stay above 2% YoY until 4Q, we expect the MAS to hold again at their next meeting with the earliest chance for some policy adjustments carried out only at their October policy meeting.

Singapore inflation bounce will be watched by MAS

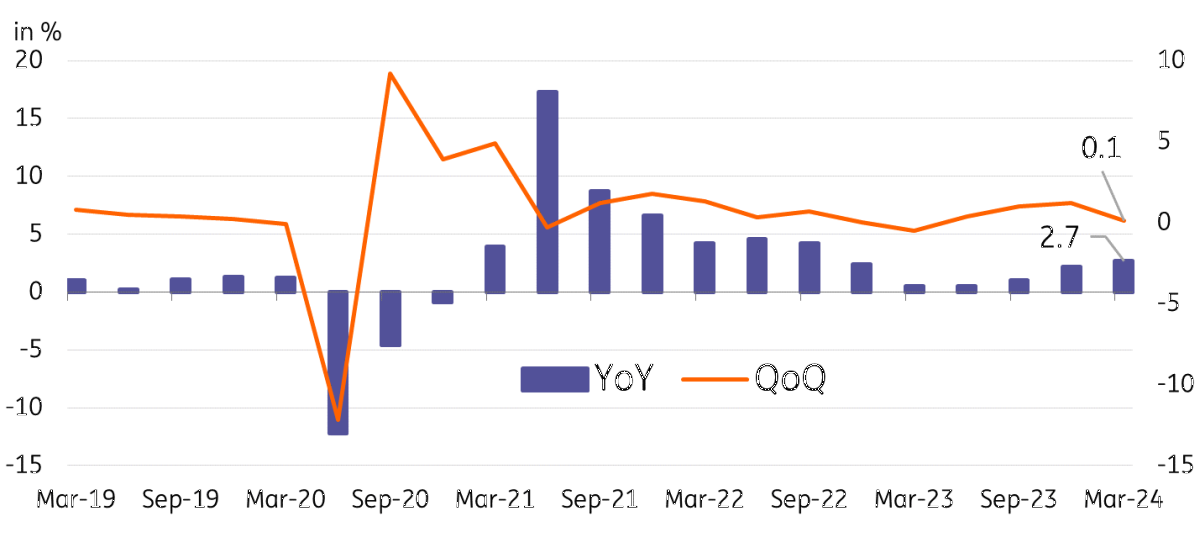

First quarter GDP slips below market consensus

First quarter GDP expanded 2.7% YoY, which was below market expectations for a 3.0% YoY gain. From the previous quarter, the economy grew 0.1% which was also below forecast for a 0.5% expansion. We had expected a strong showing for first quarter GDP given the boost from a concert series held in March, which was expected to deliver strong sales for services related to tourism.

The disappointing showing was on the back of soft manufacturing and construction activity, which both contracted. Meanwhile, the trade sector was also likely a drag with non-oil domestic exports struggling to rebound sharply due to soft global demand.

We expect GDP to remain challenged in the near term given the lacklustre outlook for global trade while the economy will remain reliant on the services sector with the number of tourist arrivals approaching pre-Covid levels.

First quarter GDP disappoints but MAS expecting growth to strengthen in 2024

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap