Singapore: Inflation slips below expectations but stays hot

Headline inflation inched up to 6.6% year-on-year but settled well below market expectations

| 6.6% |

January headline inflation (YoY) |

| Lower than expected | |

Price pressures still evident in January

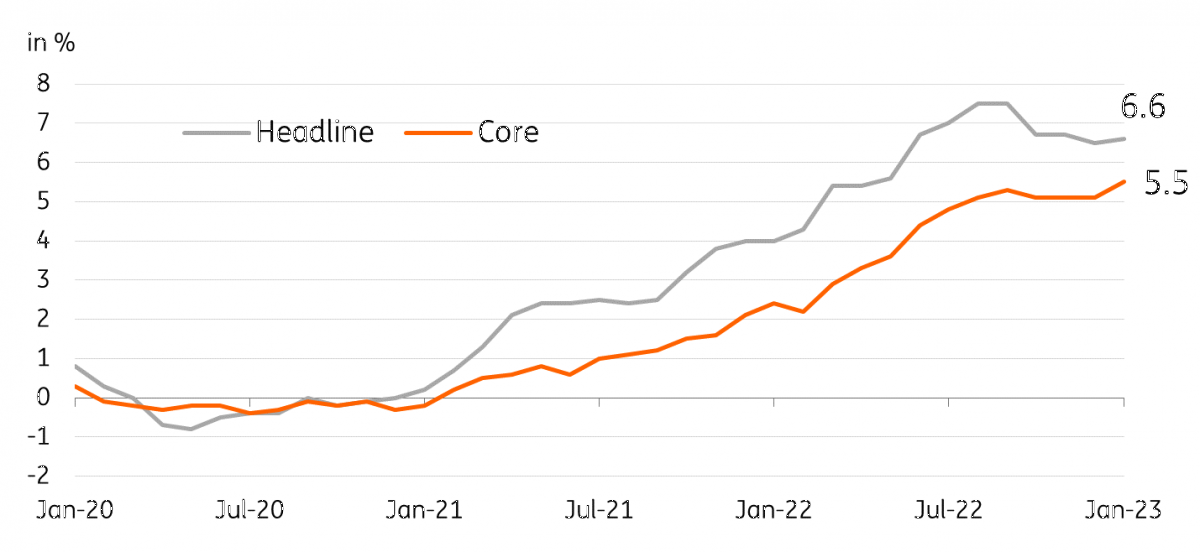

January headline inflation ticked higher but settled much lower than what market participants had expected. Headline inflation hit 6.6% YoY (from 6.5%) driven by high food (8.1%), transport (11.9%) and clothing & footwear (6.9%). Meanwhile, core inflation rose further to 5.5% YoY, up from 5.1% previously. The pickup in prices could be traced in part to the recent increase in the goods and services tax (GST) which should factor into price pressures for the rest of the year.

Recent trends in retail sales data hinted at still robust domestic demand, which is also likely adding upward pressure to prices. Finance Minister Lawrence Wong indicated recently that inflation was expected to remain elevated for at least the first half of the year.

Core inflation has yet to peak

Despite inflation miss, MAS still likely on notice

The market consensus had pointed to headline inflation surging to 7.1% YoY and core inflation rising to 5.7% but both the actual headline and core measures settled below expectations. Despite the downside surprise, price pressures remain evident, especially on the demand side, as inflation for recreation & culture stayed high at 6.7%. With today’s report, we believe that the Monetary Authority of Singapore will retain its hawkish stance while monitoring price developments ahead of its April meeting.

We will be getting one more inflation report before the April meeting and this should be pivotal in determining whether the MAS will need to tighten its policy stance further or wait to see the impact of its cumulative tightening measures carried out since late 2021.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap