Singapore inflation rises less than expected

A bit of food and a bit of clothing helped keep inflation heading up this month - next month may see a return to 1.0% inflation

Headline inflation doesn't really warrant any MAS response

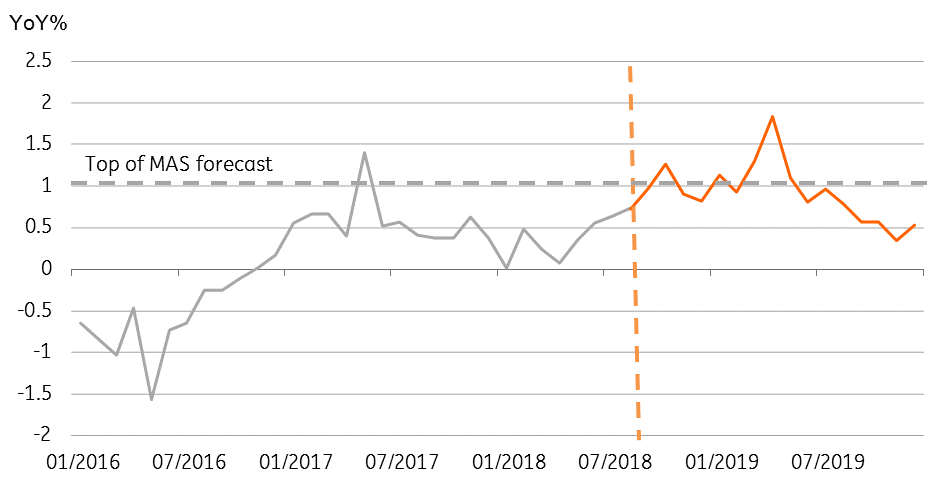

AT 0.7%YoY, Singapore's inflation is low and has been below 1.0% since May 2017, when it briefly spiked higher on a technicality. Prior to that, you have to go back to August 2014 to find headline inflation at 1.0% "legitimately". Today's figures don't appear to take us much closer to 1.0%, the top of the Monetary Authority of Singapore's target range for 2018.

But the long wait may soon be over. If average monthly outcomes for all of the Singapore's components over the last three years prevail next month, and that includes a fairly soggy 2016/2017 set of figures, then we could see a 1.0% inflation rate reached again as soon as the September figures next month.

Actual headline and forecast inflation

Core inflation unchanged at 1.9%

The MAS core inflation rate which excludes private transport costs and accommodation did not rise in August from the July 1.9% rate. This inflation rate already looks fairly good compared to the usual 2.0% international benchmark for "sensible" core inflation. But unlike most core measures which exclude externally driven food and energy prices, The Singpaore measure is flattered by the exclusion of two of the most negative components of all items CPI basket - private transportation and accommodation. These items are not irrelevant from a consideration of domestic demand pressures, and therefore, from the stance of monetary policy.

So despite a modestly improved outlook for headline inflation over the coming months, the escalating trade war makes a change of the already slightly tightening MAS monetary policy stance in October seem very unlikely.

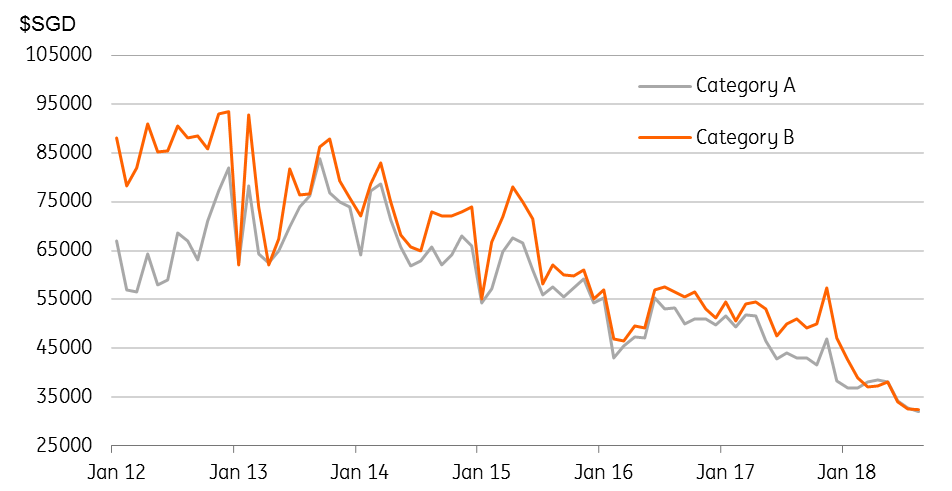

Certificates of entitlement (COE) premium (SGD)

Accommodation price deflation moderating

One small element of good news as far as the core rate of inflation goes is that deflation in the accommodation sector is abating. Though at -2.6%YoY in August, its recovery back to positive annual price changes (last seen in 2014) is being painfully slow.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

24 September 2018

Good MornING Asia - 25 September 2018 This bundle contains 3 Articles