Singapore exports beat expectations in December

Despite a weak external environment, which remains bogged down by covid infections and lockdowns, Singapore's non-oil domestic exports (NODX) rose 6.8%YoY in December, beating expectations.

| 6.8% |

NODXDecember 2020 YoY% |

| Better than expected | |

No surprises in a consensus NODX upside miss

It's not unusual for NODX forecasts to be wide of the mark, this is a series made up of a number of very volatile components. But other trade data for the region has been reasonably positive so far this month, so it is not a big surprise that the miss was on the upside.

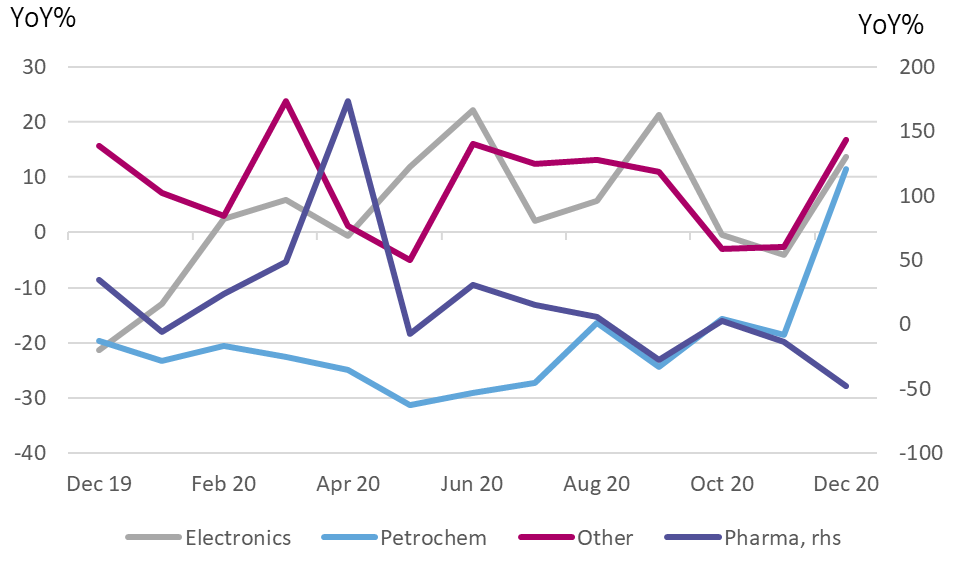

The factors leading to the outperformance in this series for December, compared to the consensus expectation for a 0.7%YoY decline, were fairly broad-based, with the big outlier being pharmaceuticals, which fell 47.5%YoY (maybe production is mainly being diverted for local consumption?)

That pharmaceutical result weighed on chemicals as a whole, though petrochemicals bounced back after an 18.6%YoY decline in November to register an 11.5%YoY gain in December.

Other than pharma, it was all good news. Electronics racked up a 13.7%YoY gain, with all major sub-components registering positive growth. We wrote about the positive semiconductor cycle last year, and it still seems to be in full swing if these numbers are anything to go by.

Non-oil domestic exports, YoY% by main component

Imports also recovering

The country breakdown of Singapore's December exports makes curious reading. And despite its comparative global strength, China was one of the weakest destinations, registering a 27.5%YoYdecline. The US, on the other hand, reeling under Covid-19, registered a 52.5%YoY increase in exports from Singapore. We probably need to see another month or two of this data to make sense of this directional curiosity.

Imports measured on an equivalent non-oil basis also improved slightly, rising 2.5%YoY, up from +1.2%YoY in November, which may indicate the domestic economy beginning to respond to stimulus measures and finding some resilience.

None of this should play into any change in policy measures, with the MAS (in our view) sticking to its flat path for the SGD Nominal effective exchange rate all year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap