Singapore economy contracts 12.6% in 2Q20

2Q data nudges our full-year 2020 growth forecast down to -6.9% from -6.1%, putting it near the weak end of the government’s forecast range, -4% to -7%

| -41.2% |

Annualized QoQ GDP fall in 2QConfirming steepest recession ever |

| Worse than expected | |

Manufacturing holds ground

Just released, the advance estimate of Singapore GDP for 2Q20 showed a 12.6% year-on-year contraction, steeper than the consensus expectation of -10.5%. This is down from -0.3% in 1Q20, though that was revised up from -0.7% previously. The 41.2% QoQ SAAR GDP fall followed a 3.3% fall in 1Q20, confirming this as Singapore's steepest recession ever. It is also the weakest result among our estimates for most Asian economies for 2Q20, although Singapore wasn’t as badly affected by the Covid-19 pandemic as some of its Asian neighbours.

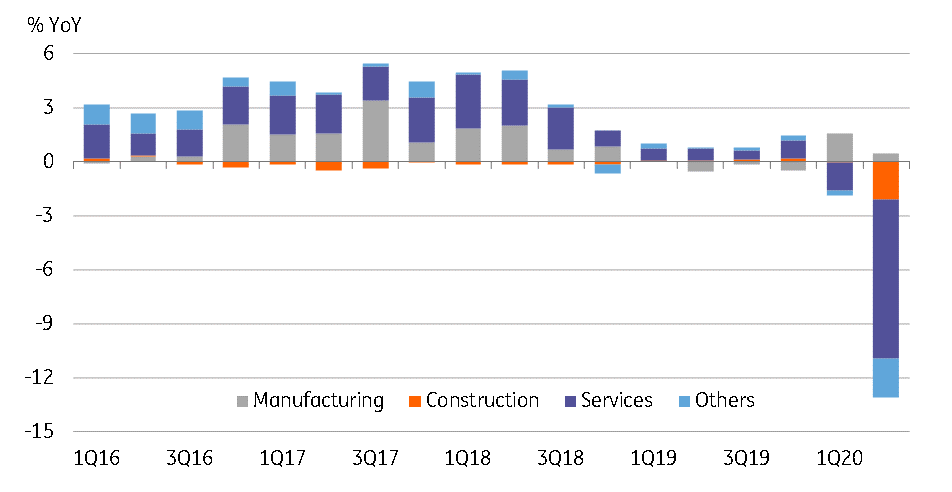

As expected, construction and services were the main drags with declines of 55% YoY and 14%, respectively. But manufacturing eked out a 2.5% gain, consistent with firmer non-oil domestic exports (up 2% in April-May). Both NODX and manufacturing have been disproportionate beneficiaries of the surge in pharmaceutical demand during the ongoing pandemic.

On the spending side, the Covid-19 circuit-breaker was a significant blow to domestic demand, as revealed by a 46% YoY plunge in retail sales in the first two months of the quarter. The advance GDP data don’t include any expenditure-based breakdowns, which is released with the final data a month later.

Industry-side sources of GDP growth

What’s ahead?

This will be marked as the bottom of the current downturn. But recovery from here on is going to be weak. Hopes are based on a large stimulus in preserving jobs and preventing further weakness in spending over the rest of the year. But persistent external uncertainty depressing exports and tourism provide no hope of a return to positive year-on-year GDP growth anytime soon, at least not over the rest of this year.

This 2Q20 GDP data alone brings our full-year 2020 growth forecast down to -6.9% from -6.1%, putting it near the weak end of the government’s forecast range, -4% to -7%. We can't rule out further downgrades to the government's view though. That said, we don’t anticipate any additional stimulus, on top of the 19% of GDP (equivalent) support measures the government has unveiled so far. Nor do we expect the central bank (the Monetary Authority of Singapore) to alter the current policy setting of zero appreciation of the SGD-NEER (Singapore Dollar Nominal Effective Exchange Rate) at the next policy review in October.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

14 July 2020

Good MornING Asia - 15 July 2020 This bundle contains 4 Articles