Singapore: Covid-19 lockdown hits spending

As things adjust to the post-Covid-19 new normal, more jobs are likely to be lost along the way, keeping consumption weak for some time to come

| -40.5% |

April retail sales growthYear-on-year |

| Worse than expected | |

Worst-ever retail sales

Singapore’s retail sales crashed by 40.5% in April from a year ago and 31.7% from the previous month (seasonally adjusted). This is the worst sales growth ever recorded since the series started back in the mid-1980s. And it was pretty much expected as the Covid-19 lockdown, starting on 7 April, dented spending.

As expected, supermarket sales continued to outperform with a 30% year-on-year surge, while non-essential consumer spending of all sorts was hit hard. Motor vehicle sales remained the weakest area with a 68% YoY plunge, which is not a surprise as we saw new registrations plunge in April. Among other big drags were watches and jewellery (-81%), clothing (-75%), department stores (-75%), and recreational goods (-55%).

More weakness ahead

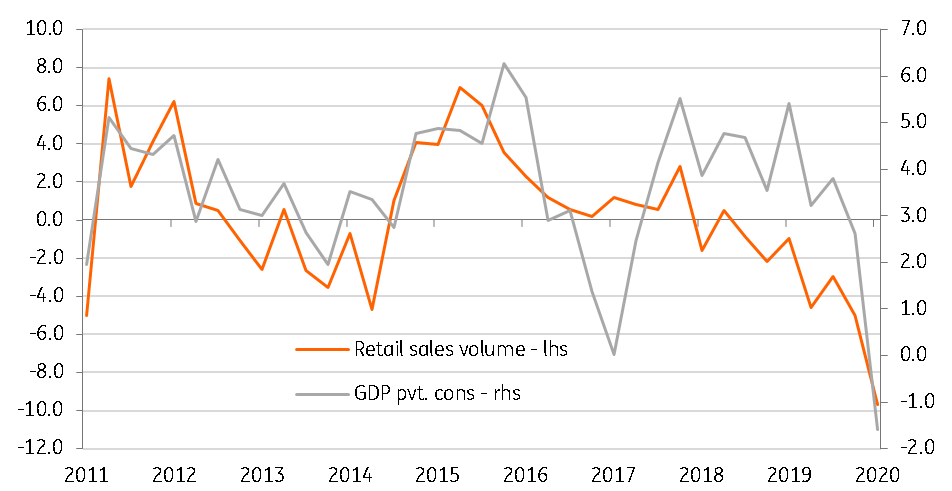

Private consumption explains almost a third of the negative swing in GDP growth in the 1Q20 (to -0.7% YoY from +1.0% in 4Q19). April data leaves no doubt that it’s going to be a far bigger drag in the current quarter, supporting our view of a 6.8% YoY GDP fall.

Continued weak consumer spending remains a baseline scenario for the rest of this year. The lockdown measures continued for all of May, followed by some relaxation starting this month. Yet, it will be a long time before the economy is fully back on its feet; a gradual three-phase reboot won’t be completed until an effective vaccine for Covid-19 is found. And, as things adjust to the new normal more jobs are likely to be lost along the way, keeping consumption weak on the expenditure-side of GDP growth for some time to come.

Retail sales vs. GDP private consumption (% year-on-year)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

5 June 2020

Good MornING Asia - 8 June 2020 This bundle contains 6 Articles