Singapore: central bank to tighten policy as GDP growth chugs along

First quarter GDP will likely show Singapore’s economy growing 3.6%, allowing the Monetary Authority of Singapore to tighten policy to safeguard against the inflation threat

First quarter GDP to display robust growth of 3.6%

Singapore’s economy likely grew 3.6% year-over-year in the first quarter of 2022, supported by healthy retail sales growth and steady gains in trade. Retail sales growth reflected the improvement in domestic activity with Covid-related restrictions lowered as virus mitigation improved at the start of the year. Robust demand for exports was reflected in a steady pickup for industrial production and the continued expansion activity as reflected in the PMI manufacturing index. The more brisk pace of economic activity may have also translated to price pressures finally surfacing on the demand side.

The inflation struggle is real

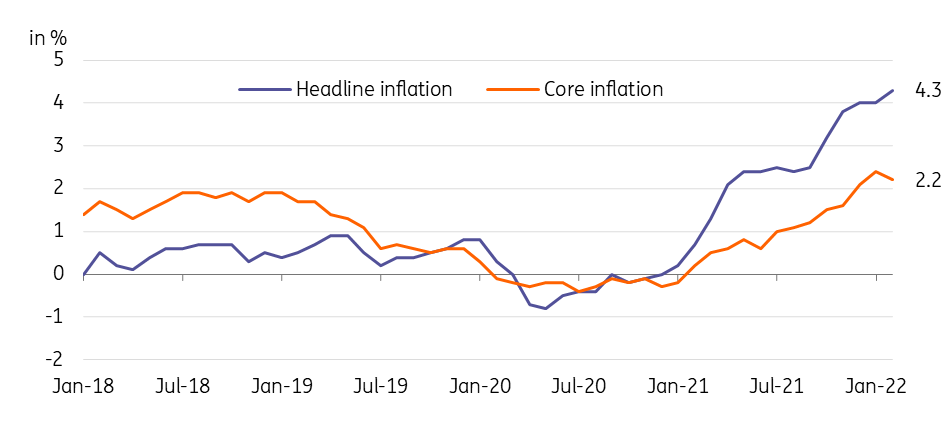

Price pressures surfaced in early 2022 with the Monetary Authority of Singapore (MAS) carrying out an off-cycle adjustment in a bid to safeguard against the inflation threat. Recent geopolitical developments have now kicked inflation into high gear as commodity prices spike with supply chains disrupted further. Headline inflation has accelerated past 4% and MAS has suggested that core inflation could very well hit 3% this year. With price pressures emanating both from the demand and supply side, we can expect both core and headline inflation to trend higher with core inflation likely moving past 3% by mid-year.

The (inflation) struggle is real

MAS to tighten but likely to leave space for additional tightening later in 2022

After two surprise tweaks to its monetary policy stance, MAS is widely expected to tighten policy on Thursday. With inflation expected to heat up in the coming months, most analysts are pricing in aggressive action from MAS on Thursday. We believe, however, that MAS will opt to adjust the mid-point of its target band to cool price pressures while refraining from touching the slope or width of its policy band.

Despite the imminent threat of inflation, we expect MAS to carry out a balanced approach to tightening as they recognise the impact of the Ukraine conflict on Singapore’s export base. As such, we believe that MAS will act decisively to tighten, however it may need to simultaneously ensure export competitiveness, especially against a backdrop of slowing global trade. Furthermore, holding off on ultra-aggressive action on Thursday gives MAS space to carry out more forceful tightening in October, should inflation accelerate further.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap