Serbia: Central bank to keep the key rate on hold at 3%

We look for a no-change decision at the 7 June meeting, as inflation should slowly resume its upward trend while the external environment warrants caution

Inflation to gradually recover

Inflation has likely reached its year-low in April at 1.1% YoY mainly on base effects as some food items price increases dropped out of the statistical base while core inflation printed 0.8% YoY in March and April, its lowest level since inflation has been measured by the consumer price index. This did not seem enough to convince the National Bank of Serbia (NBS) to further cut the key rate at the May Executive Board meeting. We look for a no-change decision at the 7 June meeting, as going forward inflation should slowly resume its upward trend while the external environment also warrants caution.

RSD under appreciation pressure

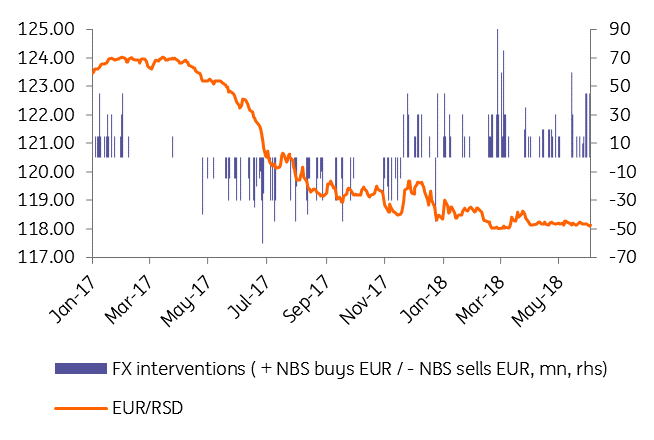

Inflation aside, the RSD appreciation pressures seem to be intensifying and could be calling for a rate cut, though in our view this is not enough to change the bigger picture. The NBS interventions have been consistently one sided since the beginning of this year: to curb RSD appreciation. Since the last Board meeting, the volume of FX interventions surpassed EUR300m, which is rather impressive for the Serbian market. Hence, we attach a reasonable probability (c.20%) for the NBS to cut the key rate to 2.75%. If materialized, such decision could be offset by a further narrowing of the standing facilities corridor from ±1.25% to ±1%.

NBS interventions

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

SerbiaDownload

Download snap