Serbia: Another non-consensus rate cut?

We expect the central bank to cut rates by 25bp to 3% after it surprised the market last month by lowering rates as both inflation and FX are well behaved

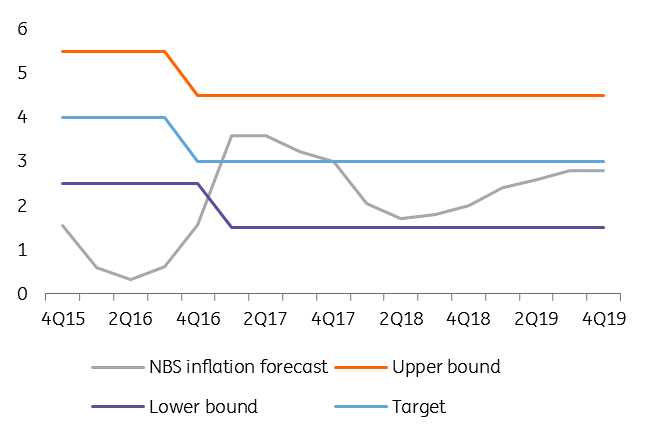

NBS forecast: a window of opportunity to cut rates

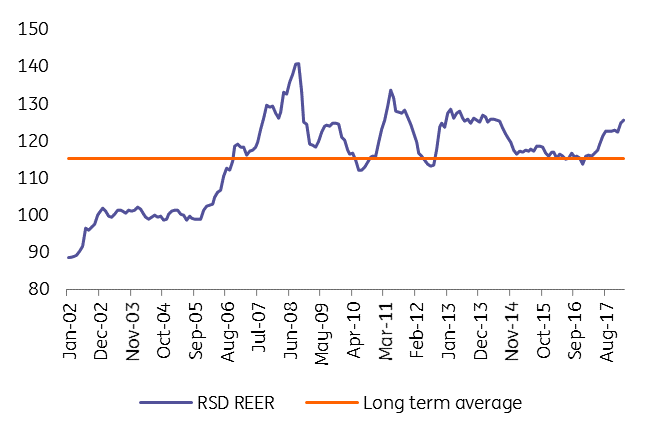

We had the same non-consensus view for the previous meeting and we got it right. Still, this time, we acknowledge that risks to our call are higher as global and country-specific geopolitical risks have increased. So far, the Dinar has shrugged-off the uncertainties. On the contrary, the FX interventions continued to be one sided: to curb RSD strengthening pressures as the real effective exchange rate (REER) shows some overshooting.

RSD REER

Nevertheless, the ongoing developments might call for some prudence, but the inflation outlook has not changed at all. Hence, provided the geopolitical noise is considered as transitory by the NBS policymakers, another rate cut is likely in our view.

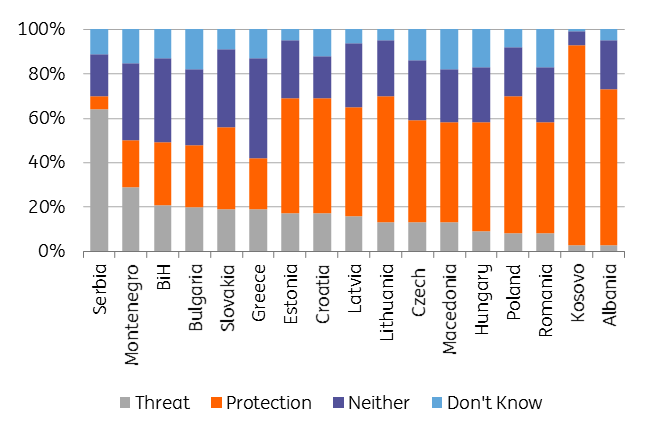

Geopolitics: NATO threat or protection?

To sum-up, we hold on to our call for a rate cut in Serbia, but acknowledge that uncertainties might lead policymakers to a comfortable “on hold” decision, while citing the need for further assessment of the recent policy easing on the inflation outlook.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

SerbiaDownload

Download snap