Tariff exemptions: Damage undone?

President Trump’s decision to exempt Canada and Mexico from import tariffs (pending NAFTA negotiations) significantly limits the impact on domestic steel and aluminium markets. Metal consumers will be tempted to breathe a sigh of relief but duty paid imports of aluminium are still required

Canada is crucial, allies even more so

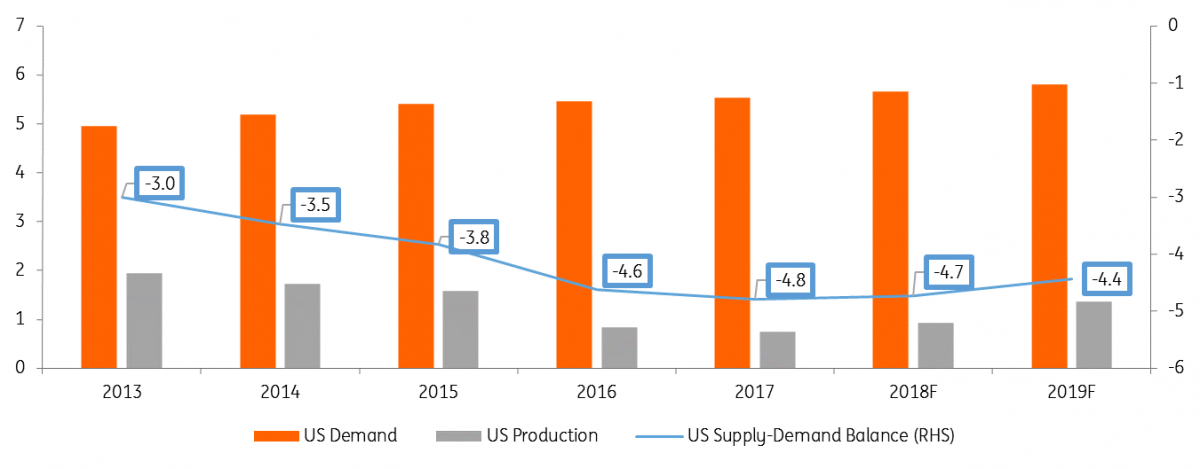

The US relies on imports for 80% of its primary aluminium consumption, a 4.8Mt void that at best falls to 4.4MT by 2019 if domestic smelters restart. Canada is by far the largest supplier providing 50% of imports. A section 232 ruling that did not exempt Canada would have therefore meant an almost 1:1 passing through of duty to the premiums paid by the consumer (around 10¢/lb). With US aluminium premiums up 60% year-to-date much was already priced in but we suspected premiums could get to 20¢/lb if Canada was included. The impact will now be considerably more limited and could become almost negligible were exemptions to spread to other ''allies": Middle East, Western Europe, Australia, New Zealand etc.

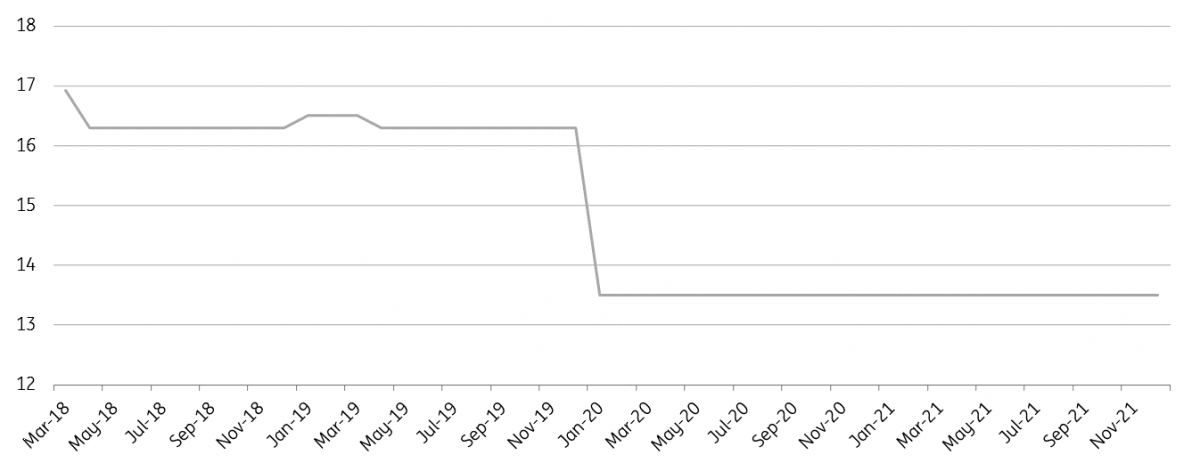

The CME forward curve for Midwest premiums now anticipates premiums have peaked at 17¢/lb with the curve in backwardation down to 13.5¢/lb by 2020. The ability for Canada to grow its exports, and further country exemptions, will influence how much more downside materialises.

Mike Bless, CEO of Century, is reported to believe that Canada will still have quotas preventing it from boosting shipments into the US tariff-free. At full capacity, Canadian production could satisfy up to 70% of US import needs but the continued outage at the ABI Quebec smelter limits contribution closer to 60% and if domestic sales cannot be neglected for foreign material then it remains 50%. Excepting a big draw down in any customs cleared off-warrant stocks (our bear case) Russian/ Middle Eastern primary metal imports still need to be incentivised regardless. Given a 10% import duty, that incentive still requires 15¢/lb although cheaper transit will allow them to be undercut by EU stocks closer to 13¢/lb. The stock pull on this major net consuming region will likely see EU premiums on the up as well. A bottleneck in US inland freight costs could also see premiums easing as the year rolls on.

Facing Facts: US imports outweigh Canadian capacity (Mt)

CME Curve sees premiums at peak (¢/lb)

Steel: More limited impact, products exemptions could be key

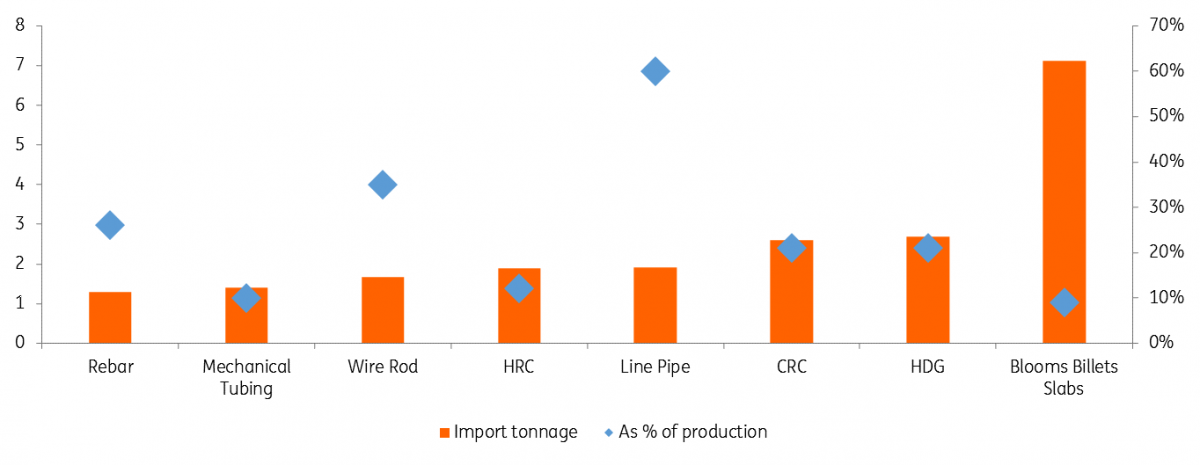

Compared to the high import reliance of aluminium, the duty impact on steel was always set to be lower. Steel imports make up only 30% of US steel demand and 20% excluding Canada/Mexico. With steel utilisation running at 74% last year, a move up to 80% and slashing exports (9MT) could quickly reduce the ex-Canada/Mexico import need below 10%. Duties paid by consumers overall will be a fraction of the 25% but the impact could vary by product. Smaller markets like line pipe have much higher import reliance but news that certain products can appeal for exemptions will likely provide relief here.

US Steel imports by tonnage and depency (Mt, %)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

9 March 2018

Week in Review: Economics trumps politics This bundle contains 5 Articles