Second-quarter inflation sets up Reserve Bank of Australia for a 50bp hike

Second-quarter CPI rose 1.8% quarter-on-quarter, taking the inflation rate to 6.1% year-on-year. While a steep rise from the first quarter, the RBA has time to respond and doesn't need to speed up the rate of tightening at its coming meeting. The monetary policy channel should continue to be a secondary one for AUD/USD, as external drivers remain dominant

| 6.1%YoY |

Headline inflation rateUp from 5.1% |

| Lower than expected | |

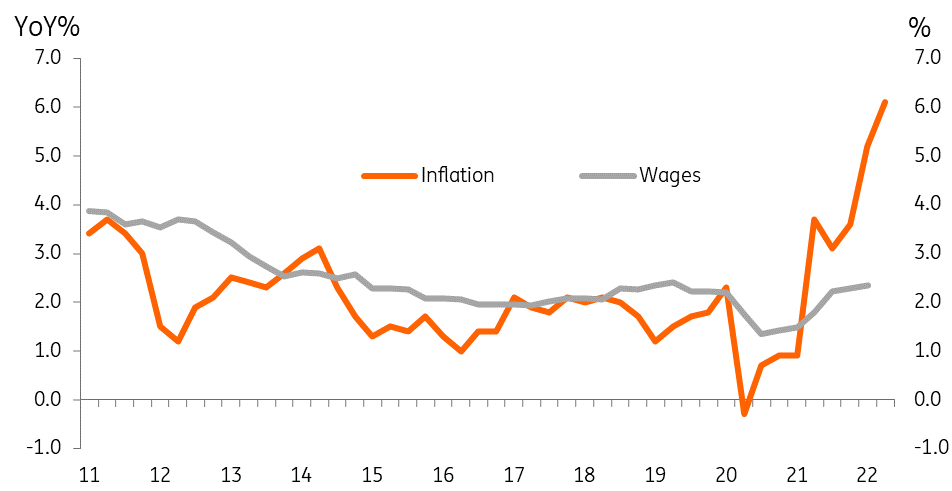

Australia wages and inflation

50bp or 25bp?

There is no question that the Reserve Bank of Australia (RBA) will hike rates at its meeting next week (2 August). The latest inflation data were the most important set of numbers since the last meeting when it hiked the cash rate by 50bp to 1.35%, and since the last labour report which set a new all-time low in the unemployment rate. The July RBA meeting was considered a 25bp or 50bp choice, and the coming meeting looks like a similar discussion and probably a similar outcome (50bp).

The market is no longer fully pricing in a 50bp rate hike following these inflation figures as it was before the inflation release. The consensus view had been for a slightly higher 1.9% outcome, and now only 44bp of tightening is priced in by futures markets. But as we heard from RBA Governor Philip Lowe at a recent speaking engagement, "the neutral nominal rate is at least 2½%. It would be higher than this if medium-term inflation expectations were to shift higher". So a 50bp hike next week will still leave the RBA with quite a lot of work to do to get rates even to neutral, and more when you consider that in all likelihood, rates will have to be raised to a moderately restrictive level, so something around 4% or higher. Doing only 25bp raises the prospect that inflation expectations will drift higher, which it doesn't sound as if Governor Lowe is keen to risk.

In the RBA's favour, it meets each month, unlike the US Federal Reserve. So a 50bp hike in August will prime the RBA to consider what additional action is warranted following the 2Q22 Wage Price Index later in August and also following the next set of labour data. A further 50bp in September will take rates to a level close to, but still slightly lower than, neutral (2.35%), and thereafter the RBA might consider that further moves can be done at a more leisurely pace depending on the run of data. So, although all moves are to an extent "data dependent", by then there will be much less of a "catch-up" component to the tightening process.

AUD: RBA still playing a secondary role

The Aussie dollar has been the most resilient G10 currency (along with CAD) to the USD appreciation in the past month, and our short-term fair value model shows that AUD/USD is currently showing no mis-valuation. By comparison, EUR/USD is currently trading around 2% below its fair value.

This means that markets have probably priced out some degree of the risk premium that was previously embedded into AUD and could have been related to fears about China’s outlook, and it appears that AUD is now factoring in a more sanguine view on China.

In all this, the RBA continues to play a secondary role for AUD/USD, and we expect any post-announcement reaction on 2 August to prove short-lived and be rapidly out-shadowed by external factors. In the current unstable market environment, risks to the 0.67-0.68 area in the pair remain material, even though our baseline scenario is still a gradual appreciation back above 0.7000 in the fourth quarter.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap