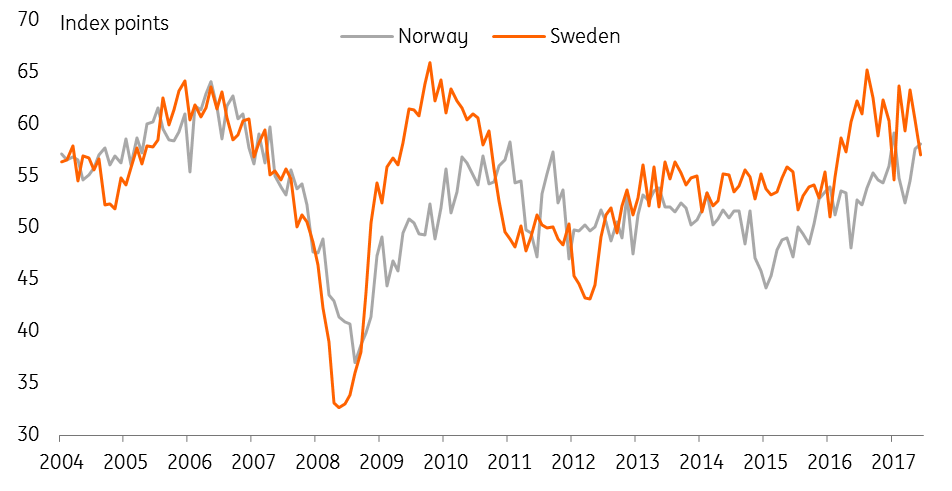

Scandi PMIs moving in opposite directions

Norway surprises on the upside and Sweden on the downside. A sign of things to come?

Both Swedish and Norwegian manufacturing PMI surveys for January were published this morning. The contrast could not be sharper: the Swedish index fell to 57.0 (vs expectations of 61.0 and a previous reading of 60.3) while the Norwegian index rose to 59.0 (compared to expectations of 56.6 and a previous reading of 57.8). While these surveys tend to be fairly volatile and one shouldn't read too much into one month's data, today's figures nonetheless highlight the contrasting trends in the two Scandinavian economies.

In essence, Sweden's economy is slowing down after several years of very strong growth (averaging above 3% since 2014), while Norway is starting to see the benefit of rising oil prices and recovering investment in the all-important hydrocarbon sector. Both are suffering from a housing market correction after years of rapid price rises and increased construction. But the Norwegian market is probably closer to reaching a bottom, and the upswing in the hydrocarbon industry will provide a strong off-set to housing weakness.

These trends help explain the stance of the two Scandinavian central banks. Norge's Bank has shifted towards a more hawkish stance, signalling a first rate hike in December this year. If oil prices hold up and the global outlook remains solid, we think they will deliver. The Riksbank, in contrast, remains in wait-and-see mode. While the inflation is back to target and a very gradual policy normalisation is underway, the Riksbank probably won't move again until it can be sure it is not hiking rates too far ahead of the ECB.

Manufacturing PMIs in Sweden and Norway

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap